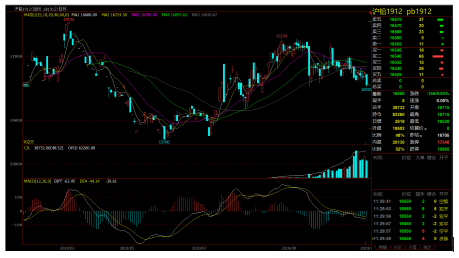

SMM news: since the return of the National Day holiday, Shanghai lead 1912 contract from the highest price 17200 yuan / ton shock downward, all the way down to the lowest price 16520 yuan / ton. Yesterday, the Fed cut interest rates for the third time, Lun lead fell sharply, also caused Shanghai lead to jump short low open. The outer plate is the first to weaken, the domestic will show a certain degree of resistance, pay attention to the following 16500 yuan 16600 yuan / ton platform support in the near future.

Guangzhou Futures Li Jun believes that from the domestic fundamentals, the price difference between primary lead and recycled refined lead is still large, and recycled refined lead still has a substitution effect on primary lead. In addition, the profit of recycled refined lead is still considerable, and the production willingness of recycled refined lead enterprises is strong. From the demand point of view, lead-acid batteries into the traditional off-season, downstream consumption performance is low. To sum up, the domestic fundamentals are empty, it is difficult to boost lead prices, Shanghai lead is expected to continue to operate under pressure.

A grand event for thousands of people in China's non-ferrous metal industry

Shanghai colored net (SMM) annual meeting is the annual event of the metal industry, with an annual participation scale of thousands of people, domestic and foreign metal industry people gathered together to review and summarize the experience and harvest of the year, and lay the groundwork for the production, operation and operation of the coming year.

This year's "2019 China Nonferrous Metals Industry Annual meeting and 2020 (SMM) Metal Price Forecast Conference" was jointly created by SMM and China Renewable Resources Industry Technology Innovation Strategic Alliance and Shanghai Nonferrous Metals Industry Association. At the same time, the first "China Renewable Metals Industry chain Development Summit Forum" was held, and SMM metal price forecasting conference and waste battery recycling exchange were set up for you to enjoy. From the development of non-ferrous metal market to the recycling of renewable resources, from the detailed explanation of policies and systems to the research and development of industrial chain technology.

This is not only a meeting, but also an industry exchange of information, collision thinking sparks of brainstorming!

"Click to sign up for SMM Annual meeting