SMM, July 17 / PRNewswire-Asianet /-

Aluminum month opening performance of the first suppression and then rise. The transaction price between Shanghai and Wuxi is between 13830 and 13850 yuan / ton, and the price is between 20 yuan and 10 yuan / ton, which is basically the same as yesterday. The transaction price in Hangzhou is between 13850 and 13860 yuan / ton. Early opening aluminum down, the holder delivery is very active, forming a more and less situation, driven by the receiving rhythm of a large household, the market trading is active, the transaction is better, with the floating of aluminum futures, the shipping price of the holder has increased, and the middleman's willingness to replenish the goods has converged at a high price, and the trading between buyers and sellers has begun to show a stalemate and a decline in trading activity. Downstream today is still on-demand procurement, because the spot price has no advantage over yesterday, wait-and-see mood has not changed, the status of receiving goods is almost the same as yesterday. The overall transaction in East China today is average.

(Xu Man 021 51595898)

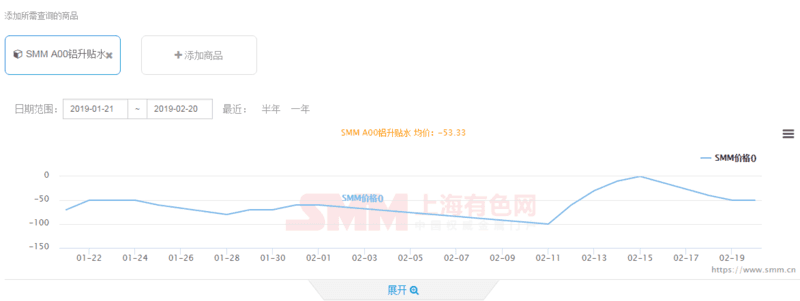

"Click to view SMM historical price data