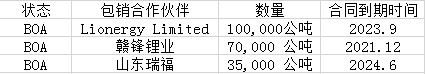

SMM7, September 9: Altura and Chinese lithium material manufacturer Shandong Ruifu signed a binding underwriting agreement, starting in July 2019, the annual output of lithium concentrate in the underwriting agreement is 35000 tons for a period of five years, reached an agreement with Shaanxi J / R optimized Energy (JRO) to terminate the existing underwriting agreement.

Altura Mining Co., Ltd. provided an update on the underwriting agreement for the Altura lithium mine, its main mine in Pilgongora, Western Australia. By June 2024, Altura had signed an underwriting agreement with Shandong Ruifu, a Chinese producer of lithium carbonate and lithium hydroxide, for 35000 tons of polybendiben ether concentrate. The first shipment of about 8000 tons under the underwriting agreement is scheduled for shipment later this month. Pricing will be based on the Li2O content formula, which includes published reference prices for lithium carbonate and lithium hydroxide.

JRO also agreed to terminate the existing underwriting agreement for the remaining 50000 tons allocated to JRO. JRO will no longer have any rights to Poly benbiben concentrate produced by Artura Lithium Industry

James Brown, managing director of Altura, said the new agreement provides further certainty and security for product underwriting. "the spin-off arrangement with Shandong Ruifu continues to expand and strengthen our customer base. Shandong Ruifu previously obtained products from Altura in 2019, from the initial goods to long-term contracts, which is a very positive step for Altura. "in view of JRO's well-known and long-term restructuring activities, the cancellation of JRO's underwriting agreement is very positive. JRO also recently sold its last stake in Altura to Ningbo Shanshan Co., Ltd., a leading supplier of lithium battery materials, and we are continuing to advance our strategic relationship with new major shareholders.

Factory capacity continues to improve and the quality of products produced by Altura continues to attract a large number of customer interest, supporting both short-term and long-term demand.

Important terms of Shandong Ruifu underwriting contract

At least 35,000 tons of grade 6% concentrate per year, with a balance of at least 24,000 tons committed in 2019.

The underwriting contract is valid until June 30, 2024.

The lowest price is US $550 per metric ton (FOB) and the highest price is US $950 per tonne (FOB equivalent), based on 6 per cent Li20 content per tonne.

The parties were able to negotiate potential underwriting for the proposed phase 2 development of Altura.

Pricing based on the Li2O content formula, which includes published reference pricing weights for lithium carbonate and lithium hydroxide.

Altura Mining underwriting Agreement Summary

Altura is an important player in the global lithium market and has a growing demand for raw materials for the manufacture of lithium-ion batteries for electric vehicles and static storage. Altura owns and operates a world-class Altura lithium project in Pilgara, Western Australia. The mine began production in 2018 and has a production capacity of 220000 tons of high-quality Sudomene concentrate. The company has completed a final feasibility study for potential phase 2 expansion and, after reviewing phase 1 operations, will make a final investment decision to increase production in the identified area to meet long-term underwriting contracts with customers and to secure funding for expansion.

"Click to enter the registration page

Scan QR code and apply to join SMM metal exchange group, please indicate company + name + main business