SMM6, 21 June: according to the (SMM) survey of SMM, this week (June 17-June 21)

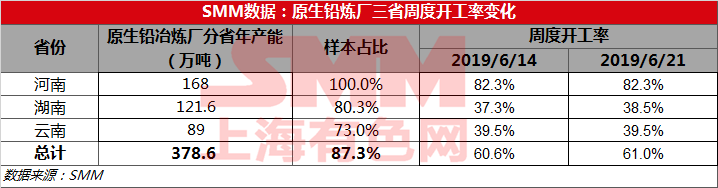

The operating rate of SMM primary lead smelter in the three provinces was 61%, 0.4% higher than that in the same period, 82.3% in Henan primary smelter, 39.5% in Yunnan primary lead smelter and 38.5% in Hunan primary lead smelter, which was 1.2% higher than that in the same period.

This week, Hunan Shuikoushan, Chifeng Mountain, Inner Mongolia, gold, silver and lead refineries have been overhauled and restored one after another, other areas of maintenance refineries are scheduled to resume production near July, the specific resumption of production will be closely followed up. According to the investigation of SMM, under the double downturn of lead price and lead concentrate processing fee, the enthusiasm of refineries is generally not high, and it is still doubtful whether the output can reach full after the actual resumption of production in the future. In the aspect of regeneration, although the raw material price shows no sign of loosening, but because the downstream consumption is too weak, the primary price gap of regeneration is still maintained at 100-150 yuan / ton, which is difficult to give strong support to the lead price.

Scan QR code and apply to join SMM metal exchange group, please indicate company + name + main business