SMM, June 18 / PRNewswire-Asianet /-

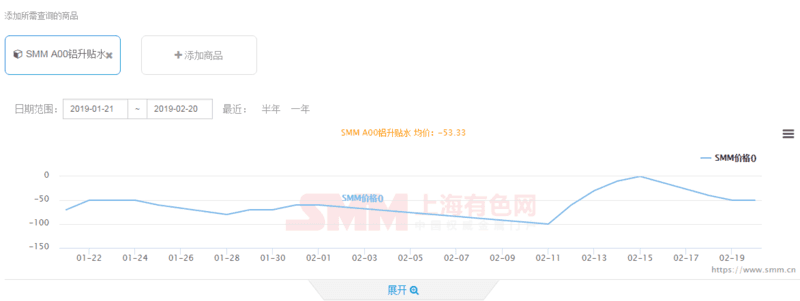

Aluminum trading in the first stage of the month to maintain interval volatility, the end of the period fell sharply, the second stage of the slow climb. In the morning, the trading price in Wuxi market in Shanghai was between 13840 and 13850 yuan / ton. With the sharp fall in aluminum price and the announcement of market quotation, the spot price in Wuxi in Shanghai began to focus on 13850 to 13860 yuan / ton. In the afternoon, the price fell by 40 yuan / ton compared with yesterday, and the trading price in Hangzhou was between 13870 and 13880 yuan / ton. Today, a large household is still not on the wire procurement notice, at the same time from the disk after the month, the aluminum price upside down plus rising water status has not changed, the holder shipment is very active, some middlemen low price trial replenishment, although the two sides inquiry quotation is positive, but the actual transaction is general. As aluminum prices fell for a few days, superimposed orders gradually weakened, downstream today's performance on-demand procurement, attitude wait-and-see, the delivery is not much. Today, the overall transaction in East China is poor.

(Xu Man 021 51595898)

"Click to view SMM historical price data