SHANGHAI, Jun 12 (SMM) –

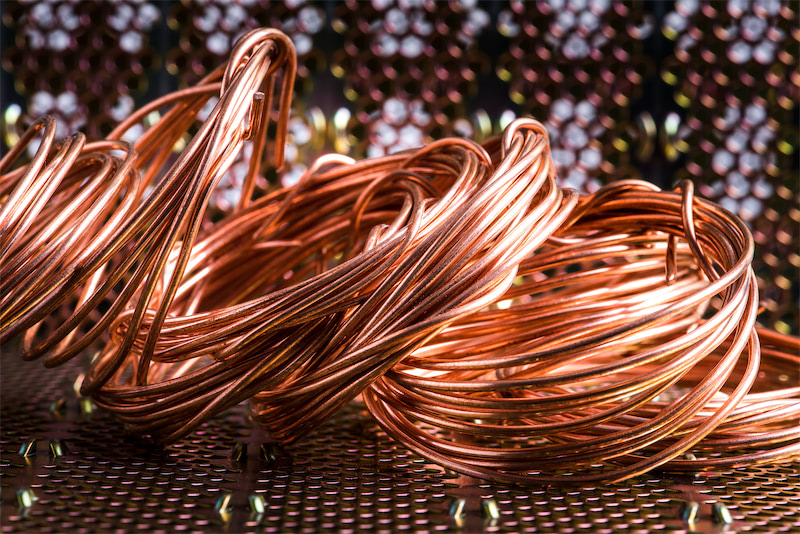

Copper: Three-month LME copper came off from earlier highs to finish Tuesday 0.24% higher at $5,891/mt, while the most traded SHFE August contract pared earlier gains to end the overnight session lower at 46,650 yuan/mt. A sharp increase in US crude inventories eroded the traction in copper prices. LME copper is expected to trade between $5,850-5,890/mt today, with its SHFE counterpart at 46,300-46,800 yuan/mt. Spot premiums are seen firmer at 60-120 yuan/mt as prices of futures dipped.

Aluminum: Three-month LME aluminium climbed to an intraday high of $1,797.5/mt on Tuesday before it lost most of those gains to close the trading day at $1,778/mt. The unwinding of short positions \accounted for the gains on the day. LME aluminium is expected to trade between $1,770-1,820/mt today. The most active SHFE August contract came off from earlier highs to end overnight 0.25% higher at 13,985 yuan/mt. As investors monitor Chinese economic data slated for release today, SHFE aluminium is expected to trade between 13,900-14,200 yuan/mt, with spot premiums of 10-30 yuan/mt over the June contract.

Zinc: Improved market sentiment and a pause in the growth of LME zinc inventories bolstered LME zinc on Tuesday, which rebounded 1.78% to end at $2,519/mt. The cancellation of LME zinc warrants grew expectations of lower inventories. LME zinc is expected to consolidate above the $2,500/mt level today, with most transactions at $2,500-2,550/mt. The most active SHFE August contract opened higher on a strong LME counterpart overnight before a load-up of short positions forced it to relinquish some gains to close 0.62% higher at 20,420 yuan/mt. SHFE zinc remains under the pressure from greater production across Chinese smelters, and is expected to trade rangebound between 20,300-20,800 yuan/mt today.

Nickel: London and Shanghai nickel prices jumped, bolstered by concerns about supply from Indonesia, the world’s major nickel ore and nickel pig iron (NPI) producer, where have been hit by torrential rain and floods. Three-month LME nickel advanced 2.37% to close at $11,900/mt on Tuesday, and the SHFE July contract rose 1.5% to end at 97,920 yuan/mt overnight. LME nickel is expected to trade between $11,800-12,000/mt today, with its SHFE counterpart at 97,000-99,000 yuan/mt. Spot prices are seen at 96,500-98,500 yuan/mt.

Lead: Three-month LME lead continued its strong performance for a second straight day on Tuesday, rising 1.57% to close at $1,910.5/mt. It might recover the ground at $2,000/mt if it shrugs off resistance at $1,900/mt. The firm LME lead buoyed the most active SHFE July contract to a high of 16,265 yuan/mt overnight before the buildup of short positions depressed it to close 0.25% lower at 16,190 yuan/mt. With strong resistance from shorts, SHFE lead underperformed its LME counterpart. It might lose all gains from its recent rebound if LME lead pulls back.

Tin: Three-month LME fluctuated to close 0.08% higher at $19,215/mt on Tuesday. Support is seen at $18,700/mt, while resistance is at $19,500/mt. As shorts added their positions, the most traded SHFE September contract fell from a higher open overnight, and closed 0.07% lower at 144,750 yuan/mt. Support is seen at 143,500 yuan/mt, while resistance is at 146,000 yuan/mt.

![[SMM Analysis] The "Counter-Cyclical" Logic of Copper Smelting: When Sulfuric Acid Becomes the Main Product](https://imgqn.smm.cn/production/admin/news/cn/thumb/cWPFD20180621153942.png?imageView2/1/w/176/h/110/q/100)

![BC Copper 2604 Closed Lower with a Wide Trading Range, Pressured by Both Geopolitics and Interest Rate Cut Expectations [SMM BC Copper Commentary]](https://imgqn.smm.cn/usercenter/pJSbE20251217171713.jpeg)