SMM5 31 March news: yesterday, the US dollar rose and fell back, the Federal Reserve said that it began to implement a new round of bond purchases in October, and the US GDP and core PCE prices were revised down in the first quarter, especially the PCE price index directly revised down 0.3 percentage points in January. At just 1 per cent, well below the Fed's target of 2 per cent, US gold rose two days to close to $1300. The dollar has been strong in recent months and is on its way up. In contrast, gold began to go downhill after hitting a new high on Feb. 20, and has not yet been released from the shackles of the downward channel to this day, the dollar has been quite strong in recent months, in contrast, gold began to go downhill after hitting a new high on February 20.

Recent trend chart of gold

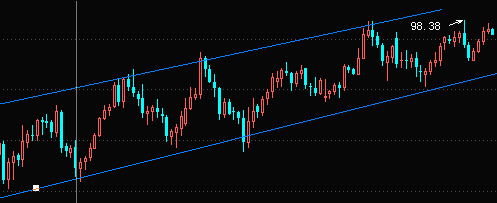

Recent trend chart of the dollar

1300 is a very important barrier for gold. If it can strongly break through the Dayang line of 1300 and break the downward channel, the next market of gold is still foreseeable. If the downward channel cannot be broken today, then gold will continue to run in the channel. Waiting for the next breakthrough. Although gold has withdrawn from the currency circle, it is considered a reliable form of risk aversion as a payment tool recognized by central banks around the world. With the escalation of the Sino-US trade war, the change of prime minister caused by Britain's Brexit, coupled with Trump's uncertain diplomacy and the collective recession of the global economy, gold will make a big difference in the second half of the year.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)