April 3, 2019: from April 2 to 3, 2019, at the "2019 SMM small Metals Industry Summit" hosted by SMM, Huang Di, senior analyst of small metals at SMM, gave a speech on the summary and future discussion of antimony, bismuth, selenium and tellurium in 2018, as well as SMM price methodology.

"View SMM exclusive spot metal historical price data

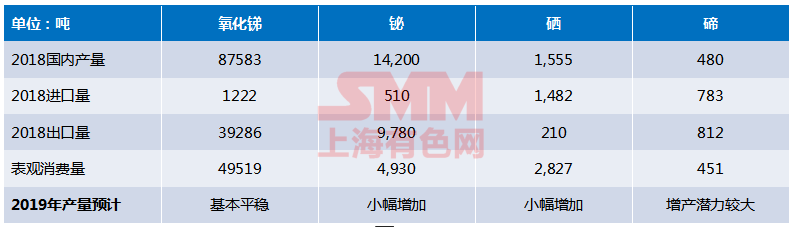

SMM estimates that in 2019, it will be difficult for the small metals industry to open new smelters under the continued action of environmental high pressure, but the expansion of basic metals will provide an adequate supply of raw materials. As many small metals are associated with basic metals, and copper smelting and lead and zinc smelting enterprises are still expanding, so the supply of raw materials is relatively sufficient, indium, selenium, bismuth, tellurium and other varieties have the possibility of increasing supply. The continuous effect of environmental protection and high pressure will become a factor restricting the expansion of production, because many small factories have been eliminated in previous years, and most of the enterprises still in operation are more formal, so the output is not easy to be reduced on a large scale due to environmental protection. The increase in consumer demand is also a major factor in stimulating the expansion of production, and tellurium has the potential to increase production from a consumption point of view.

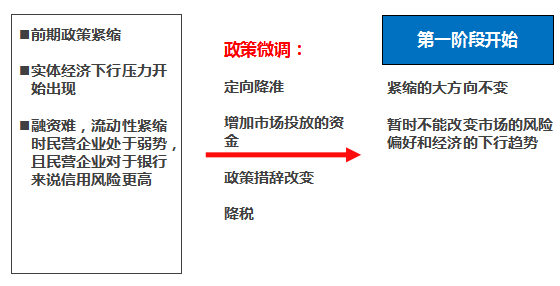

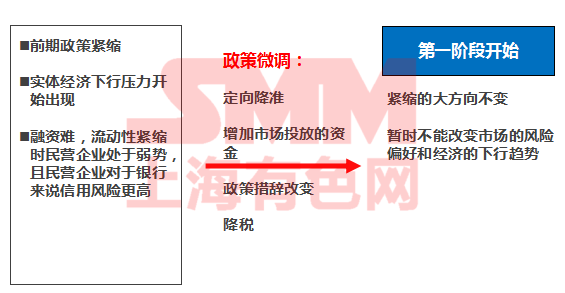

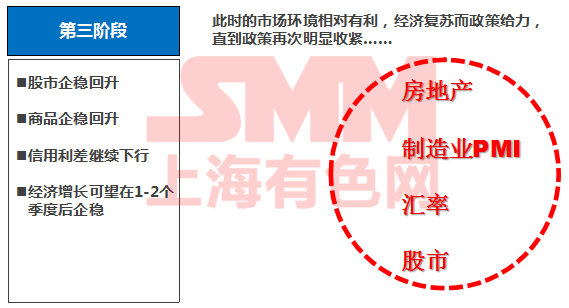

At present, there are some views in the market, bullish on gold throughout the year, China's macro-economy as a whole is not optimistic, as early as the end of the year or even next year will improve; deleveraging delayed, but still around all kinds of gray rhinoceros; The impact of the trade war has eased, but the conflict between China and the United States will continue to perform in other ways. Chinese stocks have one after another of goodwill from January to April, and US stocks have fluctuated sharply and US dollar assets have come under pressure. Property purchase restrictions are loose, investment real estate is a better stage of sale opportunities.

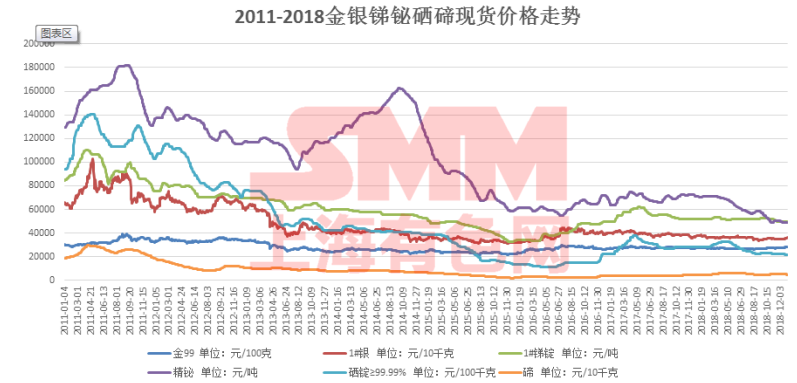

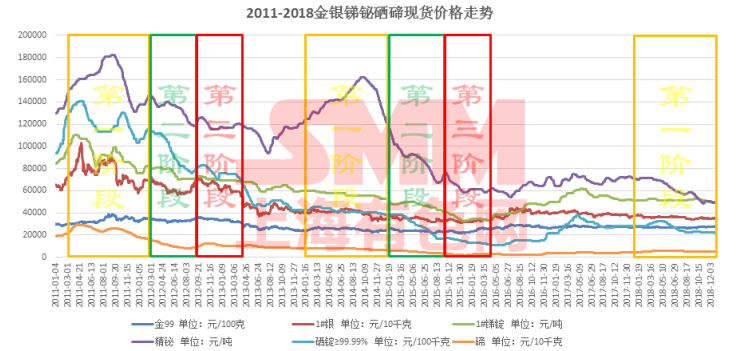

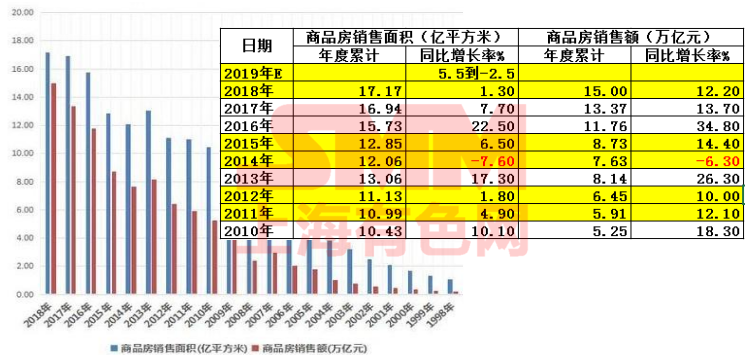

Comparison of small metals with various price trend data:

The spot price trend of gold, silver, antimony, bismuth, selenium and tellurium from 2011 to 2018 can also be divided into three stages.

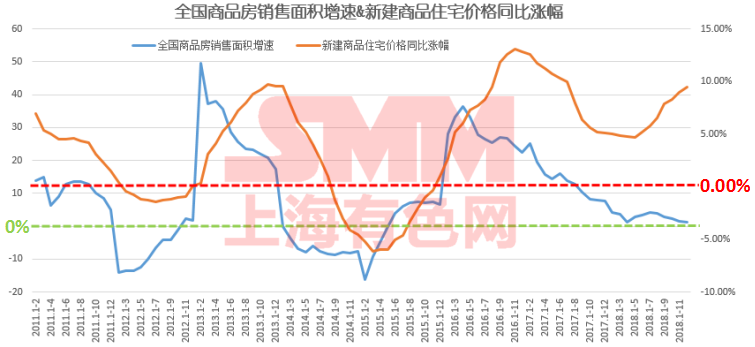

The growth rate of sales area of Commercial Housing & the year-on-year increase in the Price of newly built Commercial Housing

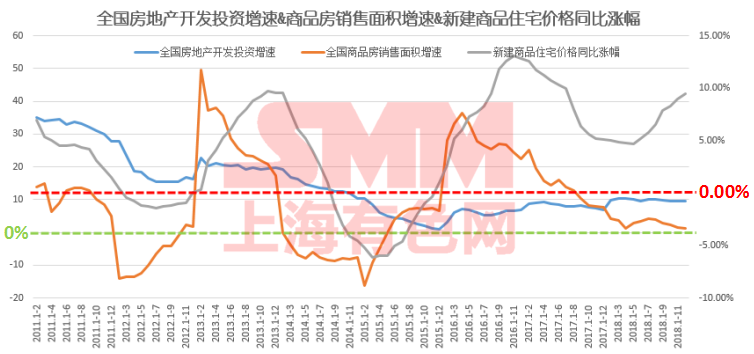

The growth rate of National Real Estate Development Investment & the growth rate of Commercial Housing sales area & the year-on-year increase in the Price of newly built Commercial Housing

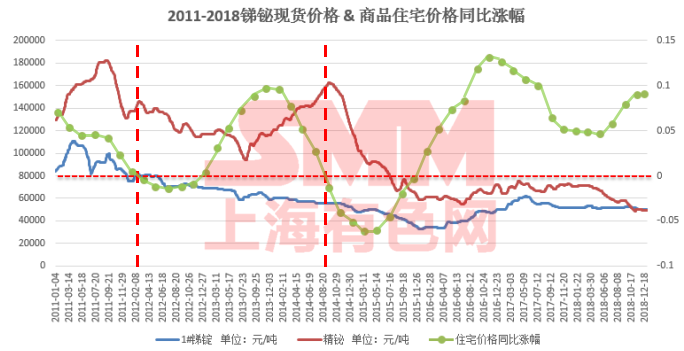

Spot Price of Antimony and Bismuth from 2011 to 2018 & year-on-year increase in Commercial Housing Price

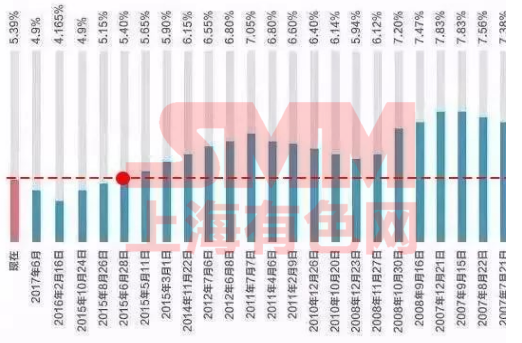

Property regulation faces interest rates of 6 to 7 points or more, this time the benchmark interest rate rose 15 to 20%, or 5.39%, unlike in the past, the gap is very large.

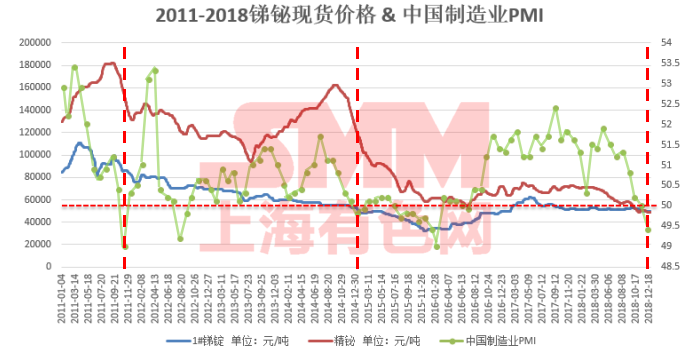

Spot Price of Antimony and Bismuth from 2011 to 2018 & PMI of Chinese Manufacturing Industry

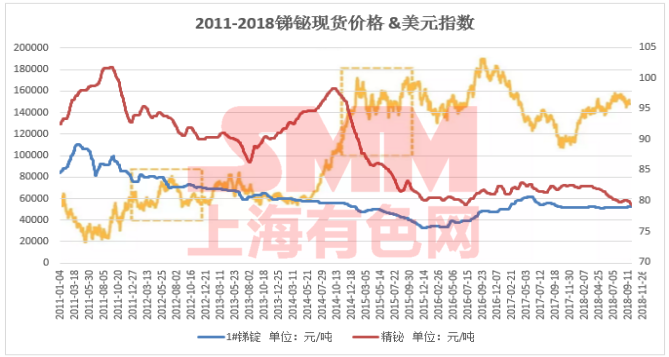

Spot price of antimony and bismuth from 2011 to 2018 & US dollar index

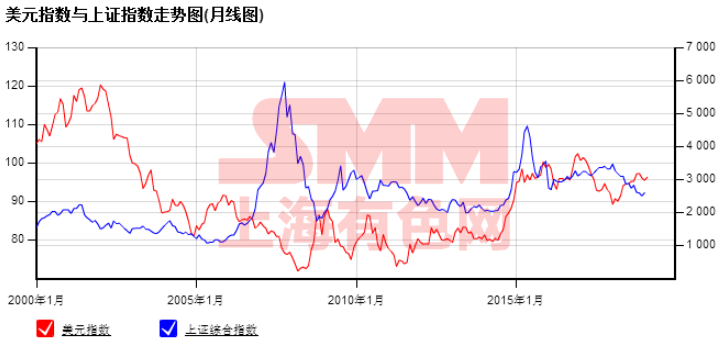

Shanghai Stock Exchange Index & US Dollar Index

Scan QR code, apply to join SMM metal exchange group, please indicate company + name + main business