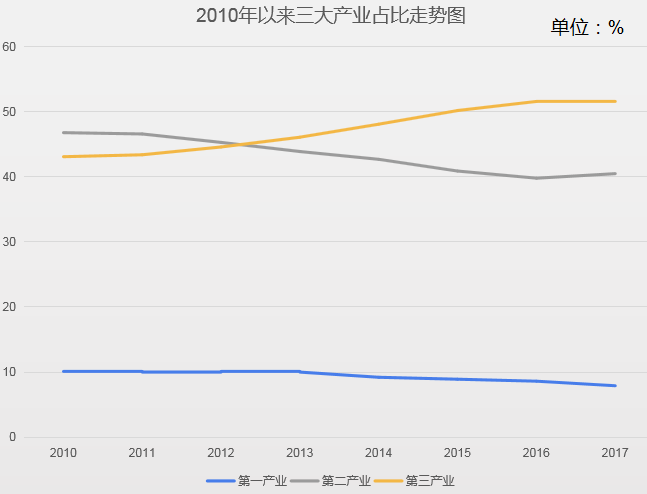

SMM1, March 8-while China's GDP has grown by leaps and bounds in recent years, the industrial structure is also undergoing positive changes. The following figure shows the changes in the three major industrial structures since 2010.

The United States has always been a highly developed country in the service industry, accounting for as much as 80 percent of GDP. This is the result of 200 years of development, making the financial-led service industry in the United States occupy an extremely important position in the economic development of the United States. In recent years, China's economy has also appeared a high trend of financialization, which is a problem worthy of attention. Realistically speaking, China's development is not yet suitable for financialization, and the future of China's economy is still in the manufacturing industry.

Why would you say that? The biggest of the so-called service industries is finance. The financial sector is famous for its high valuation and high bubble. After 2000, thanks to the Fed's low interest rate policy, house prices began to rise, and then fueled by the developed financial industry in the United States. The whole of the United States is crazy about housing, so that in the end, there is a down payment for buying a house, no mortgage for loans, old, weak, sick and disabled to buy a house and other funny phenomena, which seems very ridiculous today, but it was really what happened in those days. After the house price bubble was punctured by the rise in interest rates, the financial tsunami swept the whole world, which brought a great impact to the whole world. Now the U. S. stock market bubble has come again, U. S. stocks rose 10 years in a row, absorbing countless wealth, seemingly very beautiful stock market, in which the risks should not be underestimated. Finance is a large reservoir for the United States, and the United States will occasionally collapse under such a complete capital system. China is subject to many restrictions, such as imperfect institutional system, inadequate financial supervision, lack of understanding of financial risks, lack of experience, and so on. The risk of playing finance is very great. At present, after nearly 10 years of savage growth, the financial industry has begun to take shape, the financial industry has become one of its own, the position of finance in economic development is getting heavier and heavier, and the trend of economic development is becoming more and more obvious. But don't forget the original intention of developing the financial industry, finance is to serve the real economy.

China is a big manufacturing country, but not a powerful country. The powerful countries are Japan, Germany, and the United States. We can't do aircraft engines or chips. Our manufacturing industry is still a long way from being a powerful country. We need manufacturing, which directly reflects the level of productivity of a country, which creates real wealth, not bubbles. The German economy is the European NO.1, because it has manufacturing. The first thing President Trump did when he came to power was to revive the manufacturing industry, and the manufacturing powers were at the top of the GDP rankings. Throughout the history of the development of several major powers, we all rely on manufacturing families to get rich, and then move the low-end manufacturing industry out of the country to focus on high-tech manufacturing. We also need to continue to dig deep in the manufacturing field and develop our own core technology. In order to complete the economic transformation, in order to kill China's future, technological innovation is not driven by the will of the people? This is not by playing business models, playing virtual economy, burning money competition to play out.

If the manufacturing industry wants to return, it must control the development of the financial industry. The disadvantages brought about by financial development have been exposed in recent years. The government, enterprises, and residents are desperately trying to increase leverage. The bubble of housing prices is not only a potential risk. Moreover, in turn, to curb the development of the manufacturing industry, finance will add fuel to the flames in the middle, the strong supervision of the financial industry must continue, and the financial chaos must also be constrained by the system, otherwise returning to the manufacturing industry is empty talk. The hard work of the Chinese people makes the world ashamed, in the future we need to be more pragmatic, calm down to engage in technological innovation, to master their own core technology.

Scan QR code, apply to join SMM metal exchange group, please indicate company + name + main business