SMM3, 1: non-ferrous metals weak difficult to change, Shanghai lead decline expanded by more than 1%, Shanghai tin, copper, nickel concussion fell slightly; Shanghai aluminum concussion rose nearly 1%, Shanghai zinc rose slightly. The black system continued the concussion consolidation situation, coking coal fell more than 1%, coke, thread, iron ore, hot roll rose slightly.

China's official manufacturing PMI fell to a 19-month low in February, with production and new orders falling sharply, mainly due to a general shutdown and production cuts by companies affected by the Spring Festival. However, China's Caixin manufacturing PMI, announced today, rose to its highest level since August last year and is expected to stabilise as corporate production gradually returns to normal after the festival.

The dollar rose to a five-week high on Wednesday after Fed Chairman Colin Powell expressed optimism about the economy, reinforcing expectations that the Fed will raise interest rates further this year.

Federal Reserve Chairman Colin Powell's debut in the House of Representatives on Tuesday sparked sharp market volatility, and today he will make a semi-annual monetary policy report to the Senate Banking Committee. At the same time, data such as the US PCE Price Index in January, personal spending in January, and ISM manufacturing PMI in February will also be released, and the most concerned indicator is undoubtedly the PCE Price Index, which is favored by the Federal Reserve. Data performance could have a significant impact on market trends.

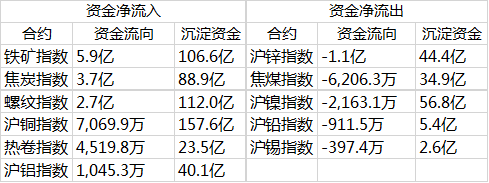

Today's capital flow

In terms of capital flows, black commodities continued to remain high and volatile, with 1.24 billion of the funds entering the market, of which iron ore received 590 million of the funds, ranking first in commodities. Most of the varieties of non-ferrous metal capital outflow, Shanghai zinc was abandoned by 110 million of the funds.

A brief Review of SMM analysts on March 1

Copper: today, the Shanghai copper main 1805 contract opened at 52410 yuan / tonne. after opening, the copper price fell slightly to 52300 yuan / tonne, and then bulls increased their positions at a low level, driving copper prices all the way up to near the daily average of 52560 yuan / ton. In the afternoon, copper prices broke through the daily average resistance and touched as high as 52710 yuan / tonne. the high level attracted short intervention, and copper prices then fluctuated and falled. at the end of the day, copper prices stabilized at around 52490 yuan / ton, closing at 52470 yuan / ton, down 470 yuan / ton, and their positions increased by 10062 hands to 245000 hands. Volume decreased by 20868 hands to 119000 hands. Positions in the Shanghai copper index rose 8348 to 856000. At present, Shanghai copper has been running below the average, short-term attention to the trend of the dollar, if the dollar continues to rise, copper prices are expected to still have room to fall. Evening focus on Markit manufacturing PMI in the United States in February. (Xu Jinqiao, Shanghai Nonferrous Metals Network)

Aluminum: the main contract of Shanghai Aluminum opened at 14340 yuan / ton in the morning, hit a low of 14300 yuan / ton at the beginning of the session, then the number of long tentative entrants increased, the center of gravity of aluminum prices moved up slightly, and Shanghai Aluminum closed slightly higher at 14390 yuan / ton in the afternoon dominated by the closing of short positions. The position of the Shanghai Aluminum Index decreased by 1234 to 793618 hands. on the one hand, there are expectations of removing inventory during the peak season, on the other hand, electrolytic aluminum inventory exceeds 2 million and there is room for downward movement of costs in March. therefore, both long and short periods of time are cautiously hesitant, but in the short term, The market is more optimistic about the expected performance of inventory removal in the peak season, so short-term aluminum prices still have a small amount of action. (Wang Rui, Shanghai Nonferrous Metals Network)

Tin: last night Shanghai tin 1805 contract mainly in the vicinity of 148200 yuan / ton concussion, today opened 147930 yuan / ton, intraday trend volatility fell, mainly due to long continued to reduce positions; In addition, there were signs of short market entry in the afternoon, the trend continued to be depressed, hitting a minimum of 147200 yuan / ton, and finally closed at 147330 yuan / ton, down 850yuan / ton from the previous day's settlement price, down 0.57 per cent. The transaction increased by 48 hands in 12466 hands and decreased by 306 hands in 22170 hands. Today, most of the domestic commodities rose, but the weakness of non-ferrous metals is difficult to change, Shanghai tin concussion downward, below the test 40-day moving average support strength, short-term trend is expected to bear pressure. (Wu Xiaofeng, Shanghai Nonferrous Metals Network)

Nickel: today, Shanghai Nickel 1805 opened at 104400 yuan / ton, first suppressed and then raised. Open long to reduce the position of Shanghai nickel straight down 103490 yuan / ton, back to step on the 20 antenna after a stable rise, the center of gravity gradually close to the daily average. Towards midday closing, long positions into the market, Shanghai nickel quickly pulled up 105320 yuan / ton. In the afternoon, Shanghai nickel in short positions under pressure fell, the center of gravity fell to 104830 yuan / ton, closing at 104780 yuan / ton. All day, Shanghai nickel main contract 1805 closed in the next shadow longer Xiao Yin Xing, compared with the previous trading day settlement price fell 190 yuan / ton, down 0.18%. Trading volume increased by 7494 hands to 519000 hands, while position volume decreased by 4888 hands to 491000 hands. Daily line technical index KDJ opening down close, MACD red column narrowed, night or continuous correction, focus on the bottom 20 antenna support. Evening focus on January personal consumption spending (PCE) month-on-month in the United States and the ISM manufacturing index in the United States in February. (Zhao Manxiang, Shanghai Nonferrous Metals Network)

< updating. >