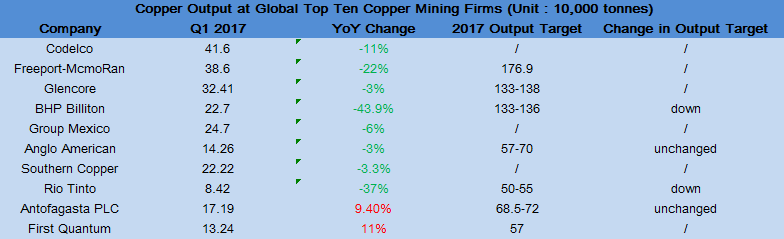

SHANGHAI, Jun. 6 (SMM) – Copper output at global top ten copper mining firms fell drastically this year as a result of frequent strikes.

SMM statistics showed copper output at the world’s ten biggest copper mining firms tumbled 14.9% year-on-year in Q1, affected by strike at Cerro Verde, Escondida and Grasberg mines, etc. BHP Billiton and Rio Tinto registered big falls. Only First Quantum and Antofagasta PLC posted growth.

Russia Aluminum, Nickel Exports Fall during January-April, But Copper Exports Grow

1. Codelco

Codelco’s copper output dropped 11% year-on-year to 416,000 tonnes in Q1, including 390,000 tonnes at its fully-owned mines. This is due to falling ore grade at old mines. Copper price recovery boosted its profitability, though.

2. Freeport-McmoRan

Freeport-McmoRan’s copper output decreased 22% year-on-year to 386,000 tonnes in Q1, and fell just 11% year-on-year when factoring out impact from selloff of Tenke mine to China Molybdenum. Lower output at Grasberg mine in Indonesia was the main reason behind decline in total output. Besides, output at Cerro Verde mine in Peru also dropped. Production at Grasberg mine was suspended for one month due to dispute with Indonesian government over export license. Unfortunately, Grasberg mine suffered strike again in May shortly after obtaining export permit, and this strike will last till June. This means Grasberg mine is running at half capacity for the whole second quarter, with output expected to change little from Q1. Chances are small for Grasberg mine to achieve 100,000-tonne output growth target in 2017 if the mine does not raise daily output in H2.

3. Glencore

Glencore’s copper output decreased 3% year-on-year to 324,100 tonnes in Q1. The decline was caused by bad weather, including hurricane in Australia, flood in Peru and higher-than-normal rains in the Democratic Republic of Congo, as well as lower ore grade at some mines. Glencore may adjust shareholdings in many mines this year. Glencore has realized 100% control over Mutunda copper-cobalt mine in Katanga province, the Democratic Republic of Congo, after raising its shareholdings in the mine in January. Glencore’s branch in Zambia, Mopani Copper Mines, plans to expand annual copper ore output from current 3.9 million tonnes to 9 million tonnes.

4. BHP Billiton

BHP Billiton’s copper output plunged 43.9% year-on-year to 227,000 tonnes in Q1, due mainly to 44-day strike at Escondida mine in Chile. BHP Billiton cut forecast for annual output at Escondida mine from 1.07 million tonnes to 780,000-800,000 tonnes after strike at the mine ended on March 24. Meanwhile, BHP Billiton lowered forecast for copper ore output in 2017 from 1.62 million tonnes to 1.33-1.36 million tonnes. BHP Billiton removed force majeure at Escondida mine more than one month after the strike ended, but said time is still needed before shipments return to normal.

5. Group Mexico

Group Mexico’s copper output dropped 6% year-on-year to 247,000 tonnes in Q1. Copper output at Asarco fell 18% due to closure of its Hayden smelter, the main reason behind lower output at Group Mexico.

6. Anglo American

Anglo American’s copper output was down 3% year-on-year to 142,600 tonnes in Q1. Output growth at Collahuasi mines was offset by lower-than-expected ore grade at Los Bronces mine. Mining business at El Soldado mine was suspended, reducing output by 3,000 tonnes. Output at Collahuasi mine increased 13% to 57,700 tonnes thanks to relatively high ore grade and improved factory performance. Although bad weather affected mining business, raw materials reserved sustained production at factory. Output at Los Bronces mine, though up 2% on a quarterly basis, fell 11% on a yearly basis to 75,800 tonnes, due to low ore grade and increased hardness. Besides, major maintenance at two copper processing plants also contributed to lower output.

Output at El Soldado mine fell about 3,000 tonnes or 11% to 9,100 tonnes in Q1 as authority disapproved mine upgrade plan. Anglo American kept full-year copper output target unchanged at 570,000-600,000 tonnes, including 50,000-60,000 tonnes at El Soldado mine.

7. Southern Copper

Southern Copper’s copper output slid 3.5% year-on-year to 222,000 tonnes in Q1. Like First Quantum, Southern Copper is worth close watching for potential growth in copper concentrate output in coming years. Expansion project at Toquepala mine is scheduled to enter production in Q2 2018 and add output by 100,000 tonnes per year. Southern Copper is committed to bringing total capacity to hit 1.2 million tonnes/year by 2021.

8. Rio Tinto

Rio Tinto’s copper output slumped 37% year-on-year to 84,200 tonnes in Q1. Rio Tinto owns 30% stake at Escondida mine in Chile, which suffered 6-week strike that began in February. Rio Tinto cut full-year copper output goal from 525,000-665,000 tonnes to 500,000-550,000 tonnes. Escondida mine is expected to return to normal production in July 2017.

9. Antofagasta PLC

Antofagasta PLC’s copper output rose 9.4% year-on-year to 171,900 tonnes in Q1, but fell 16.4% from previous quarter because of falling ore grade. Antofagasta PLC kept output target for 2017 unchanged at 685,000-720,000 tonnes.

10. First Quantum

First Quantum’s copper output rose 11% year-on-year to 132,400 tonnes in Q1. First Quantum plans to produce 570,000 tonnes of copper in 2017, up 5.6% from 2016.

It was reported that First Quantum’s Cobre Panama copper mine in Canada, with annual capacity at 320,000 tonnes, will enter operations soon, which is in line with First Quantum’s financial report. Cobre Panama mine is expected to add output by 100,000 tonnes in 2018. First Quantum’s Sentinel project in Zambia is scheduled to add annual output by 200,000 tonnes during 2018-2019, which will allow First Quantum to become another large copper mining company with annual capacity at 1 million tonnes following Freeport, BHP and Glencore. First Quantum will also become a major contributor to global copper concentrate output growth during 2018-2020.

When compared with a year ago, copper output fell at Vale and Teck Resources, but increased at China Minmetals and Kazakhmys.

SMM sees global copper concentrate output growth between 0-1% in 2017, citing possible production cuts in the second half of this year.

For news cooperation, please contact us by email: sallyzhang@smm.cn or service.en@smm.cn.

![BC Copper Fluctuated and Closed Slightly Lower, Macro Sentiment Awaited the CPI Release [SMM BC Copper Commentary]](https://imgqn.smm.cn/usercenter/YIaMU20251217171711.jpg)