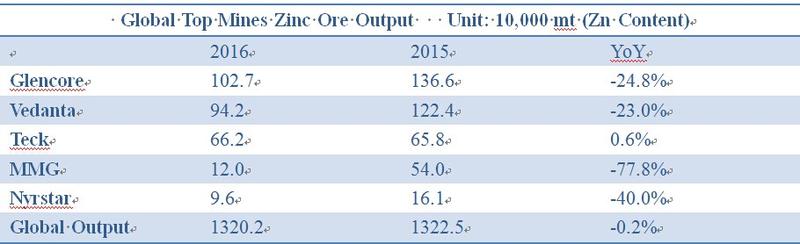

SHANGHAI, Mar. 21 (SMM) – As most global top mines cut output at their Pb-Zn mines, global zinc ore output dropped in 2016, leading to a deficit in global zinc ore supply. Zinc ore prices thus increased.

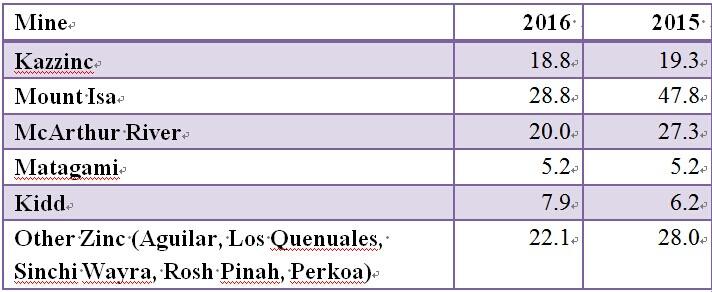

Glencore:

Output at global major zinc ore supplier Glencore dropped due largely to its output reduction announcement issued in October 2015. The company announced to slash 500,000 tonnes of zinc-contained ore output in Australia, South Africa and Kazakhstan. “The main reason for the reduction is to preserve the value of Glencore’s reserves in the ground at a time of low zinc and lead prices, which do not correctly value the scarce nature of our resources,” the company said in a statement. However, according to its 2016 annual report, Glencore didn’t reach the reduction target and operating rates increased as prices rallied in Q4 2015. Output at major mines of Glencore is as follows:

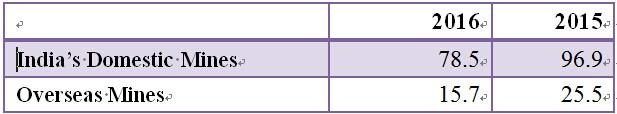

Vedanta:

Two factors are attributed to sharp decline in Vedanta’s output in 2016. First, output dropped significantly at India’s domestic mines due to output reduction announcement. Second, the company shut down its overseas Lissen mine. Details are as follows:

Besides, Vedanta’s Gamsberg project goes well and will produce the first batch of goods in fiscal year 2018.

Teck:

Output at Teck increased in 2016 while other top mines slashed output as the company’s mines held high operating rates. Ore grade at Red Dog mine dropped, but rising output remedied the problem and ore grade and recycling rate at Pend Oreille mine grew slightly. Meanwhile, the company is negotiating with Australia’s Teena mine for a 100%-stake acquisition and plans to buy 49% share of Rox Resources in Q1 2017. In this case, Teck will continue to be the global third largest zinc ore supplier.

MMG:

MMG posted a sharp decline in output due to closure of Australia’s Century mine. Century mine produced 393,000 tonnes of zinc ore in 2015, accounting for more than 70% of MMG’s total zinc ore output. In addition, MMG sold Golden Grove mine in late 2016. The company lose its position as the global fourth largest zinc producer in the future.

Nyrstar:

Nyrstar sold more mines in 2016. The company sold Chile’s El Toqui mine in June 2016 with 2016 zinc ore output at 28,400 tonnes and Honduras’ El Mochito mine in September with 2016 zinc ore output at 14,500 tonnes, and Peru’s Contonga mine in October 2016 with 2016 zinc ore output at 11,100 tonnes.

Zinc ore output at Nyrstar dropped significantly in 2016, excluding sold mines, with suspension of Middle Tennessee and falling raw ore output at Langlois and East Tennessee mines. The effect from falling output at Langlois and East Tennessee mines has estimated in Q4 2016 and Middle Tennessee mine will restart raw ore mining in Q1 2017 and reopen dressing plant in Q2 2017. Annual output at Nyrstar is expected to increase to 50,000 tonnes in October.

SMM indicated that mines slashed output intentionally or unintentionally in 2016, allowing zinc ore prices to rise continually, which ensured profits at mines. Glencore has achieved its purpose and shows signs to buy mines after getting over from debt crisis. But it is unknown that if mines will increase output in 2017 with high prices as global top mines do not elaborate details. Those mines may hold output unchanged as they satisfy profits increase from output reduction or expand output for higher profits. SMM will update actions from global top mines.

For news cooperation, please contact us by email: sallyzhang@smm.cn or service.en@smm.cn.