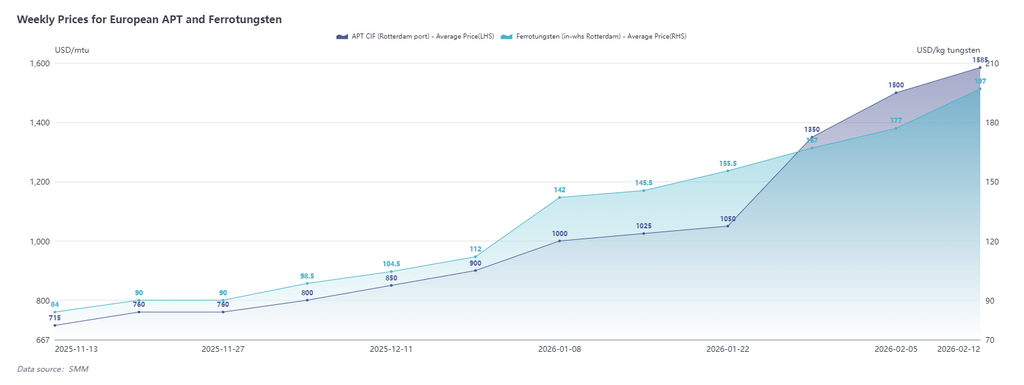

As of February 13, SMM data showed that the CIF Rotterdam port price for ammonium paratungstate (APT) was $1,500-1,670/mtu, with an average price of $1,585/mtu, up $85/mtu from February 6. The price for ferrotungsten (Rotterdam warehouse) was $189-205/kg W, with an average price of $197/kg W, up $20/kg W from February 6.

European Tungsten Raw Material Market: Stalemate with Quoted Prices but No Actual Transactions; Passive Price Increases Fail to Alleviate Resource Shortages

Since the price surge in late January, offers in the European market have continued to climb, but actual spot order transactions have been extremely limited. On one hand, downstream traders exhibit strong fear of high prices, with significantly low acceptance of the continuously rising tungsten prices. On the other hand, there is almost no spot APT raw material available locally in Europe, as the market is largely executing long-term contract orders, leading to persistently tight overall supply.

According to SMM surveys, current spot APT offers from local European traders have increased to $1,500/mtu, while offers from Chinese exporters have even exceeded $1,650/mtu, though no transactions have been reported so far. In terms of ferrotungsten, the latest transaction price in the Rotterdam area has risen to $205/kg W, significantly higher than recent prices in the Chinese market.

From the current supply-demand pattern, the European tungsten raw material market has entered a typical state of quoted prices without actual transactions, with prices passively following the upward adjustments in Chinese supplier offers. In the short term, the situation of resource shortages is unlikely to be substantially alleviated.

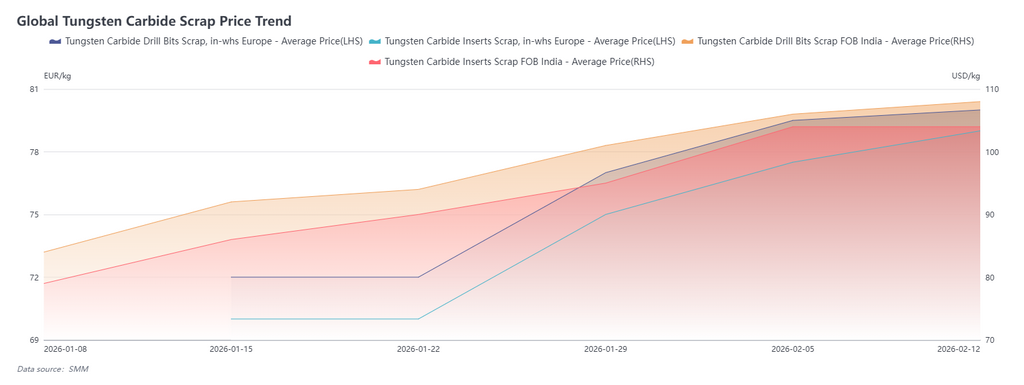

International Tungsten Scrap Market: Robust Indian Demand Drives Price Increases; European Traders Consider Following Suit

Recently, local circulation of tungsten scrap in India has been active. According to local traders, offers for tungsten drill bits with high tungsten carbide content have been raised to 10,000 Indian rupees/kg (approximately $110/kg), with ongoing procurement demand. Meanwhile, traders are actively expanding into markets in Japan, Singapore, Europe, and the US, seeking scrap export opportunities. For tungsten alloy inserts, the FOB India transaction price remains stable at $104/kg.

In contrast, tungsten scrap prices in Europe have not shown significant fluctuations, with market transactions still mainly focused on tungsten inserts scrap. Mainstream trader offers are maintained at €78-80/kg. However, as the scrap recycling market continues to heat up, some recyclers have begun considering price increases, and it is expected that prices may follow upward in the short term.

>-Click for India and EU Tungsten Scrap Price

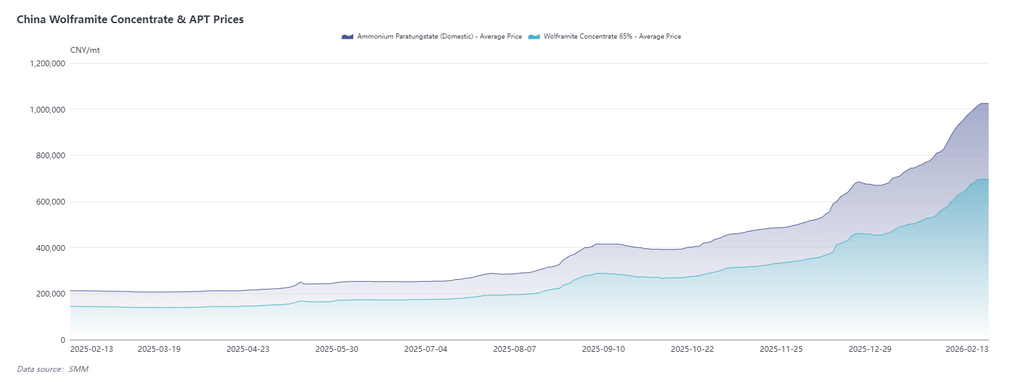

Chinese Market: Supply Contraction Drives Up Prices, Post-Holiday Uptrend Yet to Peak

Recently, despite the Chinese tungsten market entering the Chinese New Year holiday, prices have shown an across-the-board increase. Seasonal production cuts at mines and stricter control over non-tax-included businesses have led to scarce circulating tungsten ore supply, driving transaction prices significantly higher. Currently, downstream enterprises exhibit strong fear of high prices, with procurement largely maintaining long-term contract order pace and limited willingness to chase spot prices higher.

From a representative pricing perspective, the long-term contract prices for the first half of February released recently by a tungsten enterprise in Guangdong indicate an ammonium paratungstate (APT) offer of 1 million yuan/mt, up sharply by 200,000 yuan/mt MoM, reflecting that tungsten prices overall in February will continue an upward trend. Market sentiment regarding tight supply remains unresolved, providing sustained support for prices.

Looking ahead, although the Chinese market will officially enter the Chinese New Year holiday next week and current prices are consolidating at high levels, post-holiday trends may see further upside, with no clear peak signals in the short term.

![[SMM Analysis] Logistics Slowdown Causes Disruption in Goods Flow, Stainless Steel Social Inventory Rises Temporarily](https://imgqn.smm.cn/usercenter/tjmLW20251217171722.jpeg)