SMM Nickel February 6 News:

Macro and Market News:

(1) The European Central Bank held a monetary policy meeting at its headquarters in Frankfurt, Germany, on the 5th local time, deciding to keep the three key interest rates in the euro zone unchanged, in line with market expectations.

(2) The number of planned layoffs in the US surged in January, with planned layoffs soaring 118% YoY to 108,435 people, the highest level for the month in 17 years. In addition, the US JOLTs job openings recorded 6.542 million in December, the lowest level since September 2020.

Spot Market:

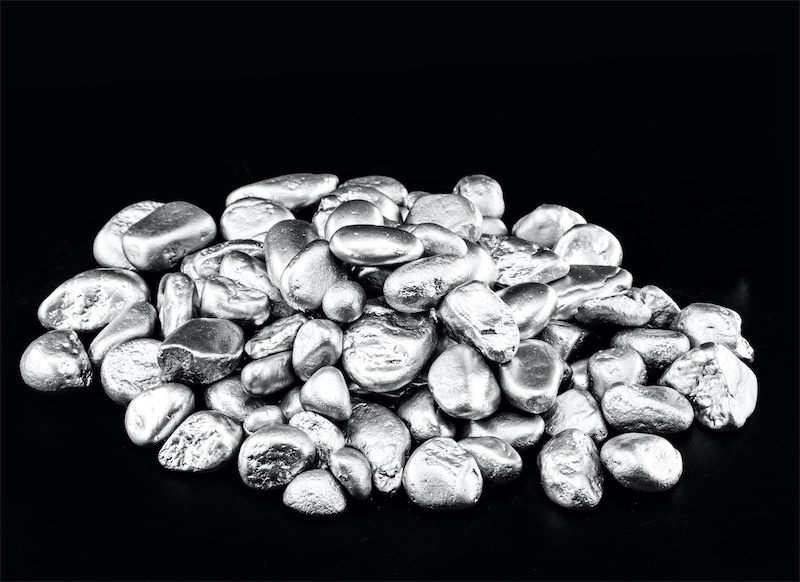

On February 6, the SMM #1 refined nickel price was 130,100-141,500 yuan/mt, with an average price of 135,800 yuan/mt, down 4,050 yuan/mt from the previous trading day. The mainstream spot premium quotation range for Jinchuan #1 refined nickel was 9,000-10,000 yuan/mt, with an average premium of 9,500 yuan/mt, up 100 yuan/mt from the previous trading day. The spot premium/discount quotation range for mainstream domestic brands of electrodeposited nickel was -400-400 yuan/mt.

Futures Market:

The most-traded SHFE nickel contract (2603) fell sharply in the morning session, breaking below 130,000 yuan/mt, before rebounding slightly. It closed the morning session at 132,270 yuan/mt, down 2.3%.

Nickel prices continued their downward trend, edging lower slightly, as the market balanced between macro pressure and fundamental support, showing an overall volatile pattern. Expectations of reduced nickel ore quotas in Indonesia persist, and nickel prices are expected to rebound in the future.

![[SMM Stainless Steel Flash] Fu'an Aims for $246B in Stainless Steel Output by 2026, Advances 600,000-Ton CR Project](https://imgqn.smm.cn/usercenter/KFwsY20251217171734.jpg)

![[SMM Stainless Steel Flash] Fujian Tsingshan's Stainless Steel Deep Processing Project Receives Construction Permit](https://imgqn.smm.cn/usercenter/Btmsv20251217171733.jpg)

![[SMM Stainless Steel Flash] EU Fastener Distributors Warn CBAM Acts as Penalty Tariff; Import Costs Surge Up to 50%](https://imgqn.smm.cn/usercenter/qLeLR20251217171733.jpg)