From January 28 to 29, 2026, the Rubaya coltan mining area in North Kivu Province, eastern Democratic Republic of the Congo (DRC), was hit by massive landslides triggered by persistent heavy rainfall. The disaster caused the collapse of multiple artisanal mining tunnels. All mining operations at the affected mining area have been fully suspended, and nearby residents have completed emergency evacuation.

As a core node in the global tantalum raw material supply chain, the Rubaya mining area accounts for more than 15% of the global total tantalum ore output. Tantalum is a key core raw material for the manufacturing of electronic end products such as smartphones and computers. The disaster and the subsequent mining suspension have imposed a potential supply shock on the global tantalum industry chain.

Driven by the news of the production halt at the Rubaya mine, bullish sentiment in the global tantalum market has risen rapidly. Stockpiling and restocking demand from downstream enterprises and traders has been concentratedly unleashed, pushing up the prices of all categories across the tantalum industry chain simultaneously. As of the time of writing, the quotations and increases of each link are as follows:

At the ore end, the collapse and production suspension have resulted in a substantial contraction of the global supply, leading to a rapid tightening of available spot supplies. On the other hand, downstream electronic manufacturers and traders have concentratedly stockpiled materials and locked in prices driven by bullish sentiment, further exacerbating the supply-demand mismatch in the circulation sector and jointly pushing up the transaction quotations at the ore end. Currently, the CIF China price of tantalum ore stands at 119–120 USD per pound, representing an increase of 27.12% compared with early December.

At the basic raw material end, the mainstream market price of 99.5% tantalum pentoxide has climbed to 2,775 RMB per kilogram, an increase of 43.41%. According to a survey by Shanghai Metals Market (SMM), domestic tantalum smelters generally show strong reluctance to sell, and the quotation of this grade of product from some enterprises has been raised to 3,000 RMB per kilogram, an increase of 55.03%.

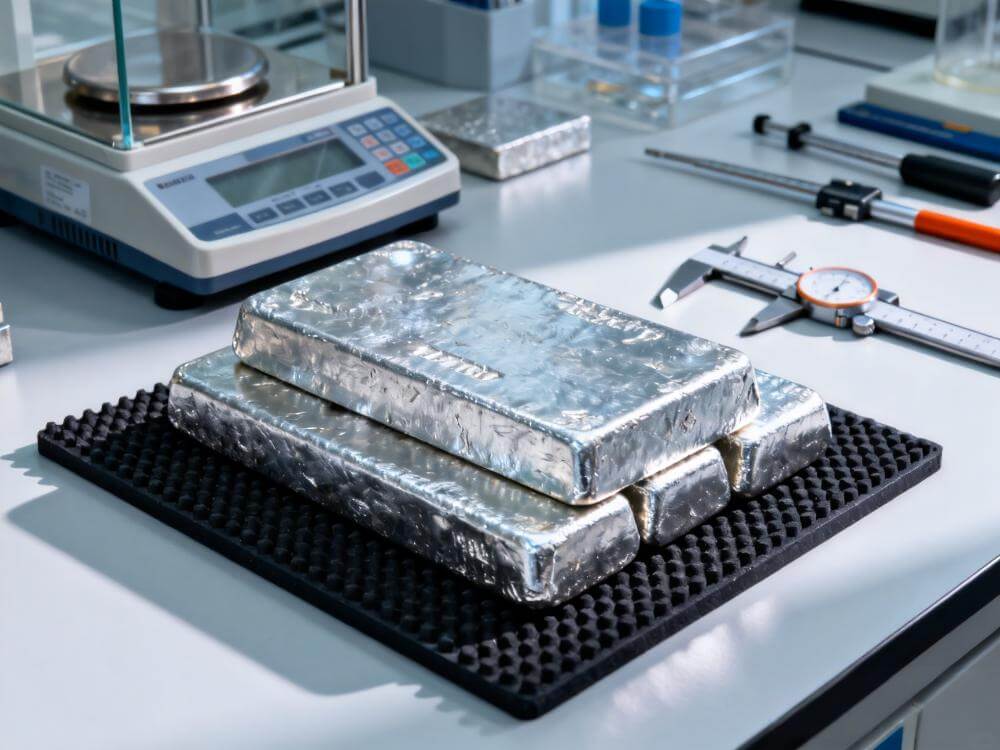

At the smelting and processing end, the overall quotation system of the tantalum market is currently chaotic, with a continuous stream of high-price transaction cases. The price transmission and transaction bargaining within the industry chain have further intensified. As learned from SMM, actual transactions of 99.95% tantalum ingots at the price of 5,500 RMB per kilogram have been concluded.

The impact of the production suspension at the Rubaya mining area is likely to push China’s tantalum prices officially into a sustained and rapid upward channel. The formation of this trend is not driven by short-term sentiment, but an inevitable outcome of the continuous deterioration of the supply-demand contradiction. The core driving factor is that most domestic tantalum smelters originally relied on the stable raw material supply from the Rubaya mining area. The sudden production suspension at the mine has directly led to a shortage of raw material inventories for enterprises, and some small and medium-sized smelters even face the hidden danger of raw material supply disruption, forcing them to cut production capacity or suspend production.

Meanwhile, the downstream demand is rigid. The production demand of terminal industries such as smartphones, computers, and new energy vehicle electronics has not shrunk significantly due to the rise in raw material prices. In addition, downstream enterprises and traders are worried about further tightening of supply in the future, so their stockpiling and restocking demand continues to be released. The imbalance between supply and demand is difficult to be effectively alleviated in the short term. Under the resonance of multiple factors, tantalum prices are expected to keep climbing, break through previous highs, and enter a new round of peak price ranges.

![Titanium Market Structure Becomes Clearer: Upstream Consolidates at Weak Levels, Midstream and Downstream Strength Expected [SMM Titanium Weekly Review]](https://imgqn.smm.cn/usercenter/tjmLW20251217171722.jpeg)