Smelting Side: European Tungsten Spot Transactions Surged, Offer Center Rapidly Shifted Upwards

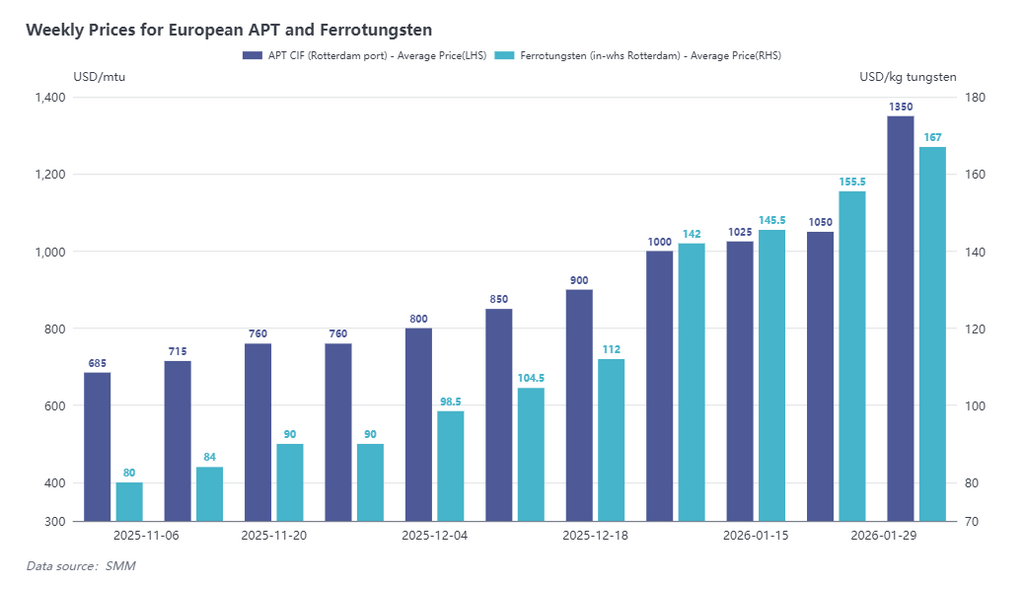

As of last Friday, SMM data showed that the price of APT CIF Rotterdam port was $1,300-1,400/mtu, with an average price of $1,350/mtu, up by $300/mtu compared to January 23; the price of Ferrotungsten (Rotterdam warehouse) was $162-172/kg W, with an average price of $167/kg W, up by $11.5/kg W compared to January 23.

Last week, European tungsten prices entered a phase of rapid increase, primarily driven by critically low downstream inventories, with some buyers making concentrated procurement of spot cargo at high prices. According to an SMM survey, approximately 20 mt of European APT was traded at $1,350/mtu last week, with a small additional volume traded at $1,320/mtu. Although the actual trading volume was very limited, these high-priced transactions significantly boosted the offer sentiment among traders in the European local market and other non-Chinese markets. By the end of last week, APT offers at Rotterdam and Baltimore ports had quickly risen to $1,400/mtu, a price level that has currently deterred most end-users.

A European trader stated, "I have to say, more and more hard metal producers are seeing their inventories bottom out. The issue of raw material shortage is becoming increasingly evident. But currently, no one knows how to solve this problem." The contradiction between tight supply and rigid demand is difficult to alleviate in the short term, and global tungsten prices are expected to continue climbing to new highs.

End-Use and Scrap: European Tungsten Scrap Prices Under Pressure, Asian Market Premiums Significant

For the end-use market and the scrap market, the price increases for products from major European hard metal manufacturers are quite limited, which contrasts sharply with Chinese producers.

According to an SMM survey, the current transaction price for scrap (covering hard metal end mills, drills, inserts, etc., with a tungsten carbide content above 90%) acquired by local European traders from factories is about €75/kg and above. These traders tend to resell the scrap to intermediaries, who then channel it to other higher-priced markets.

Currently, tungsten scrap prices in Asia are already at high levels. In the Indian market, the price for hard metal scrap (WC content 90-92%) is at ₹9,100-9,300/kg (approximately $100/kg), a level close to that in the Chinese market, and it shows a continuous upward trend. Within the Chinese market, the price for scrap tungsten drills has reached $112/kg, while the price for scrap tungsten rods has reached $117/kg. The significant price spreads existing in the global scrap market are highly likely to continue driving a new round of adjustments in global trade flows.

Ore Side: Reshaping the Supply Landscape Outside China, EQR's Multinational Tungsten Mine Project Accelerates

In 2026, global tungsten mine development officially entered an acceleration phase. According to information disclosed by EQ Resources (EQR) in its Q4 2025 earnings briefing, the company's multinational resource footprint has achieved milestone progress. At the Barruecopardo mine in Spain, through continuous optimization of production processes, the resource recovery rate has steadily increased from the initial 40% upon acquisition to nearly 70%, solidifying its strategic position as a core supplier within Europe. Meanwhile, the Mt Carbine mine in Australia successfully overcame challenges in stripping engineering and fully commenced mining operations on the Iilanthi high-grade ore vein, with production expected to achieve leapfrog growth in 2026. Against the backdrop of major global powers intensifying efforts to reshape critical mineral supply chains, the strategic reserve value of tungsten is becoming increasingly prominent, and EQR's accelerated development is becoming a crucial cornerstone for supply diversification in Western markets.

Currently, Chinese tungsten prices continued their strong upward trend in January, with the price of standard-grade wolframite concentrate increasing by 32.4% for the entire month. Constrained by the current supply-demand imbalance, the continued rise in global tungsten prices appears unstoppable. The market is currently in a wait-and-see mode, anticipating the further driving impact of the Chinese New Year holiday in February on price trends.

![European Tungsten Market Surged Significantly This Week, APT Rose Over 13%, Scrap Strengthened Simultaneously [SMM Overseas Tungsten Weekly Review]](https://imgqn.smm.cn/usercenter/qbMSp20251217171722.jpeg)