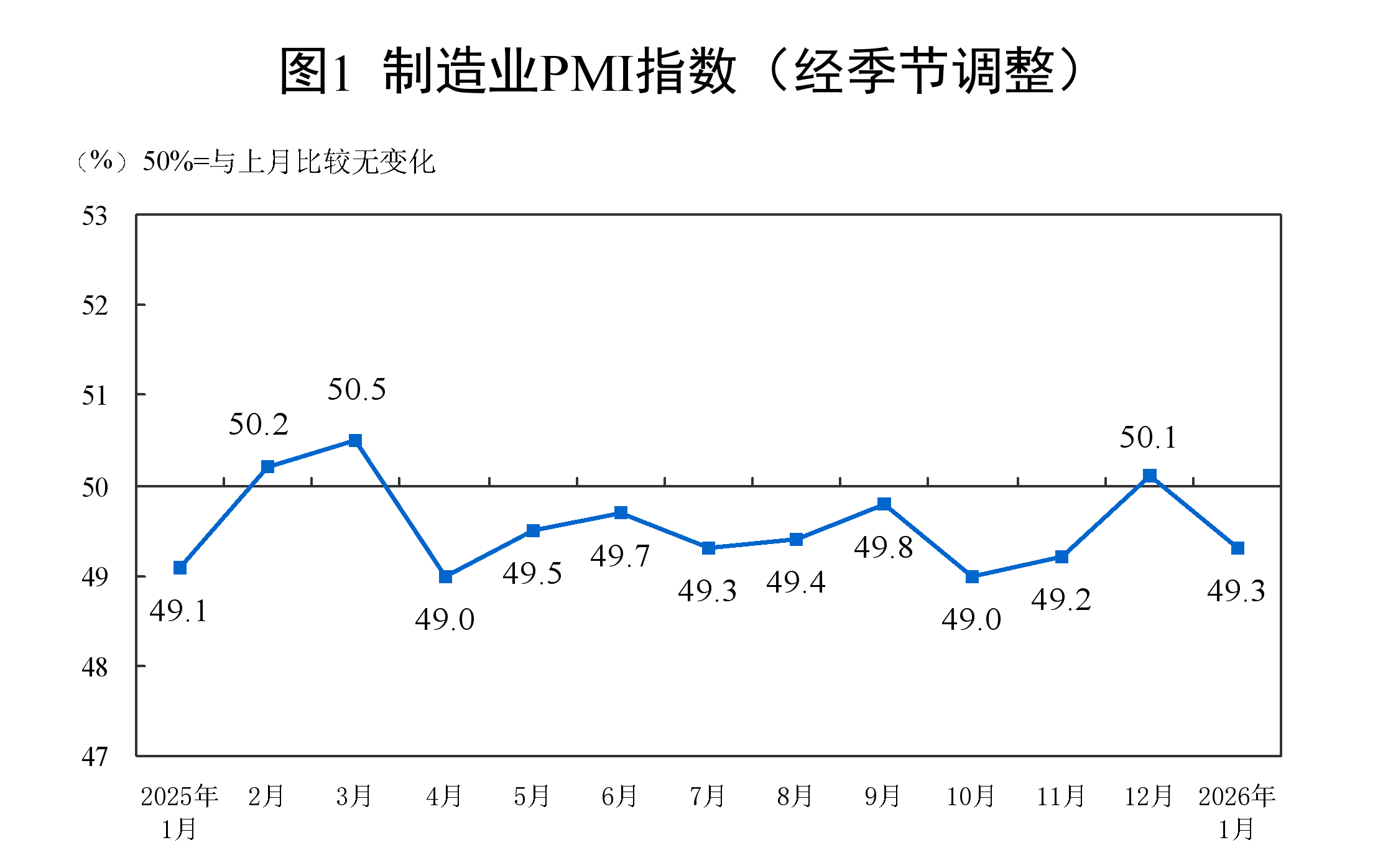

The National Bureau of Statistics (NBS) and the China Federation of Logistics and Purchasing (CFLP) released China's purchasing managers' index (PMI) for January 2026 today (31st). The data showed that in January, China's manufacturing market demand tightened somewhat, but enterprise production maintained an expansionary trend, with the industrial structure continuing to optimize. The service sector operated relatively stably, with business expectations continuously improving. The manufacturing PMI for January 2026 was 49.3%, a decrease of 0.8 percentage points from the previous month. The PMI for equipment manufacturing in January was 50.1%, and for high-tech manufacturing, it was 52%. Both equipment and high-tech manufacturing sectors are developing steadily and positively, with the manufacturing industrial structure continuously optimizing.

Operation of China's Purchasing Managers' Index in January 2026

I. Operation of China's Manufacturing PMI

In January, the manufacturing PMI was 49.3%, a decline of 0.8 percentage points from the previous month, indicating a pullback in the level of manufacturing activity.

By enterprise size, the PMI for large enterprises was 50.3%, down 0.5 percentage points from the previous month, yet still above the critical point; the PMIs for medium and small enterprises were 48.7% and 47.4% respectively, dropping by 1.1 and 1.2 percentage points from the previous month, both below the critical point.

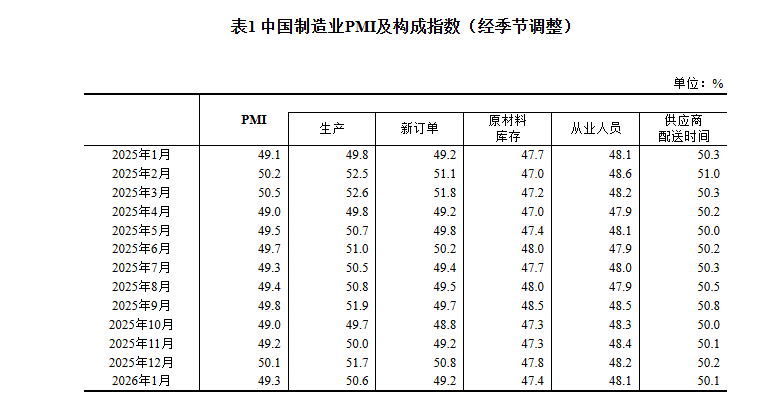

Looking at the sub-indices, among the five sub-indices constituting the manufacturing PMI, the production index and supplier delivery time index were both above the critical point, while the new orders index, raw material inventory index, and employment index were all below the critical point.

The production index stood at 50.6%, a drop of 1.1 percentage points from the previous month, yet still above the critical point, indicating that manufacturing production activities remained in an expansionary state.

The new orders index was 49.2%, a decrease of 1.6 percentage points from the previous month, suggesting a slowdown in manufacturing market demand.

The raw material inventory index was 47.4%, down 0.4 percentage points from the previous month, indicating a continued reduction in the stock of major raw materials in the manufacturing sector.

The employment index was 48.1%, a decline of 0.1 percentage points from the previous month, showing a slight pullback in the employment climate for manufacturing enterprises.

The supplier delivery time index was 50.1%, a decrease of 0.1 percentage points from the previous month, yet still above the critical point, indicating a continuous acceleration in the delivery times of raw material suppliers in the manufacturing sector.

II. Operation of China's Non-Manufacturing PMI

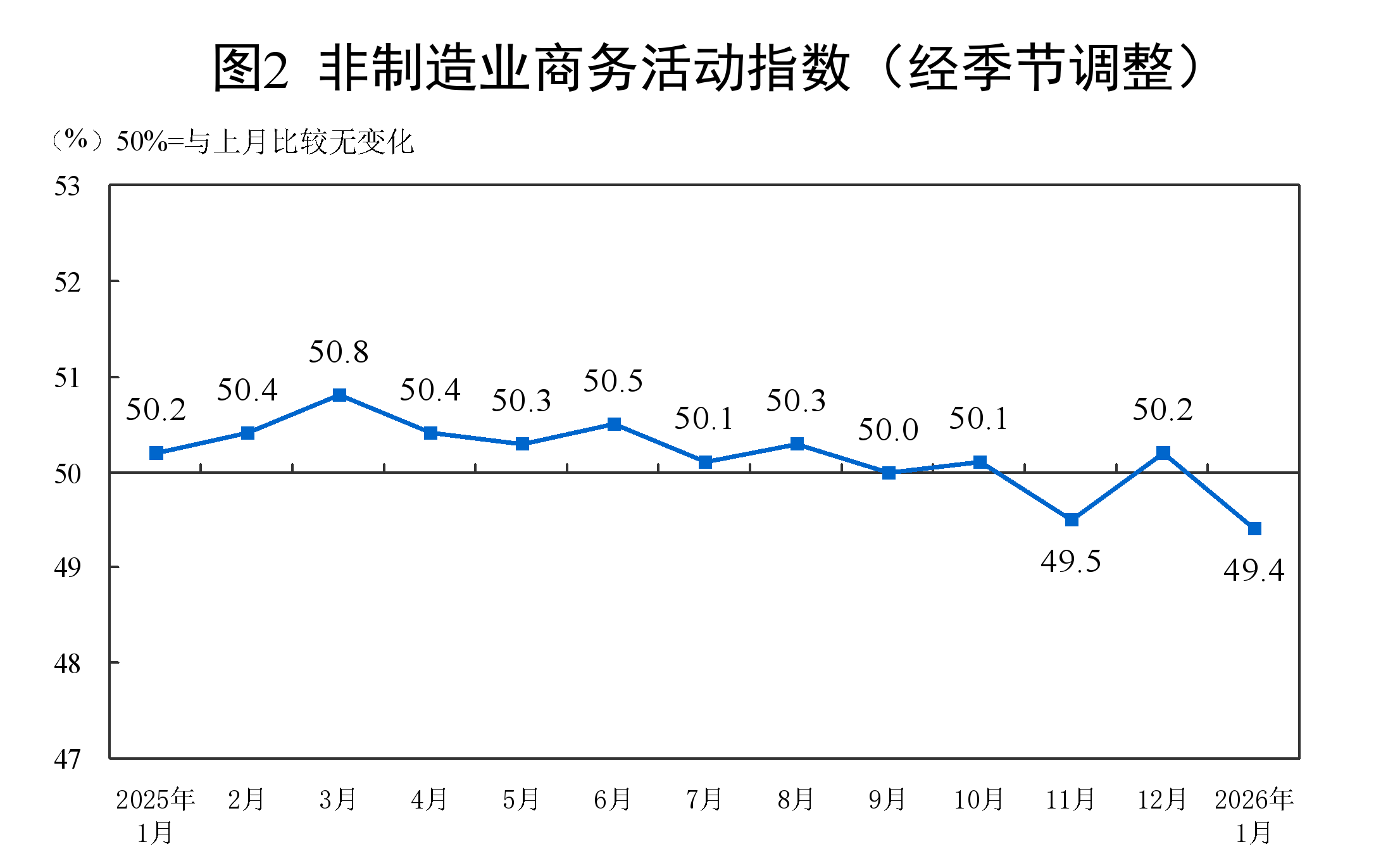

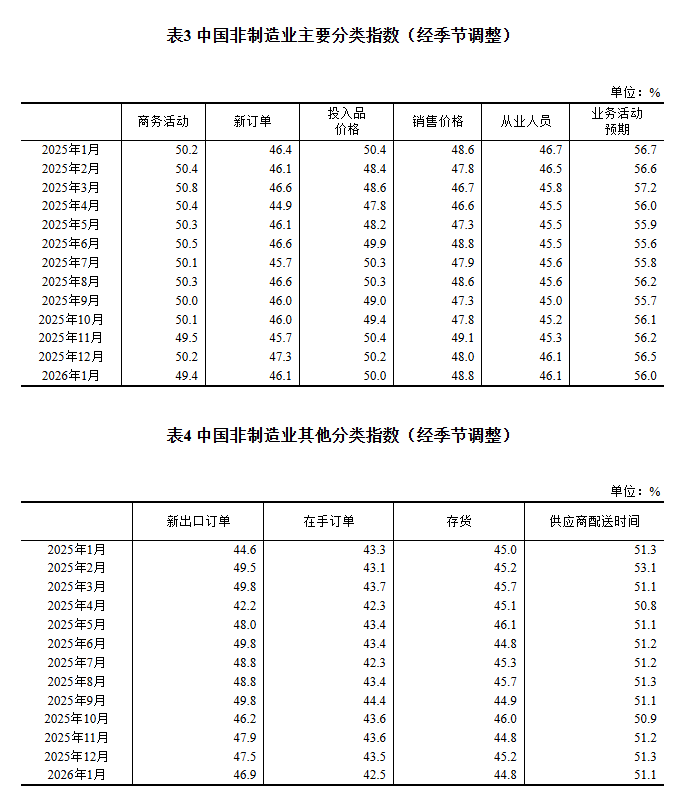

In January, the non-manufacturing business activity index was 49.4%, a drop of 0.8 percentage points from the previous month.

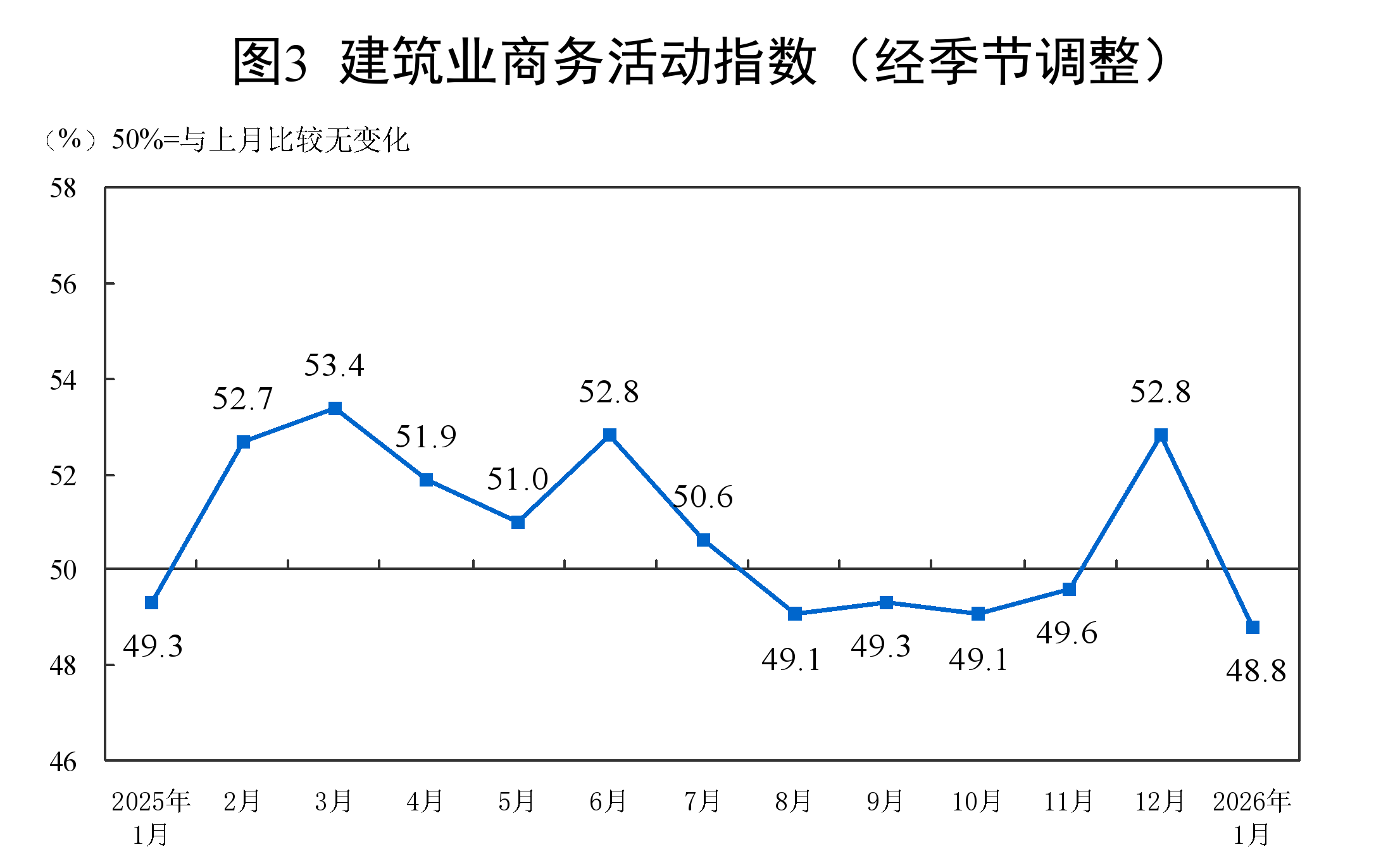

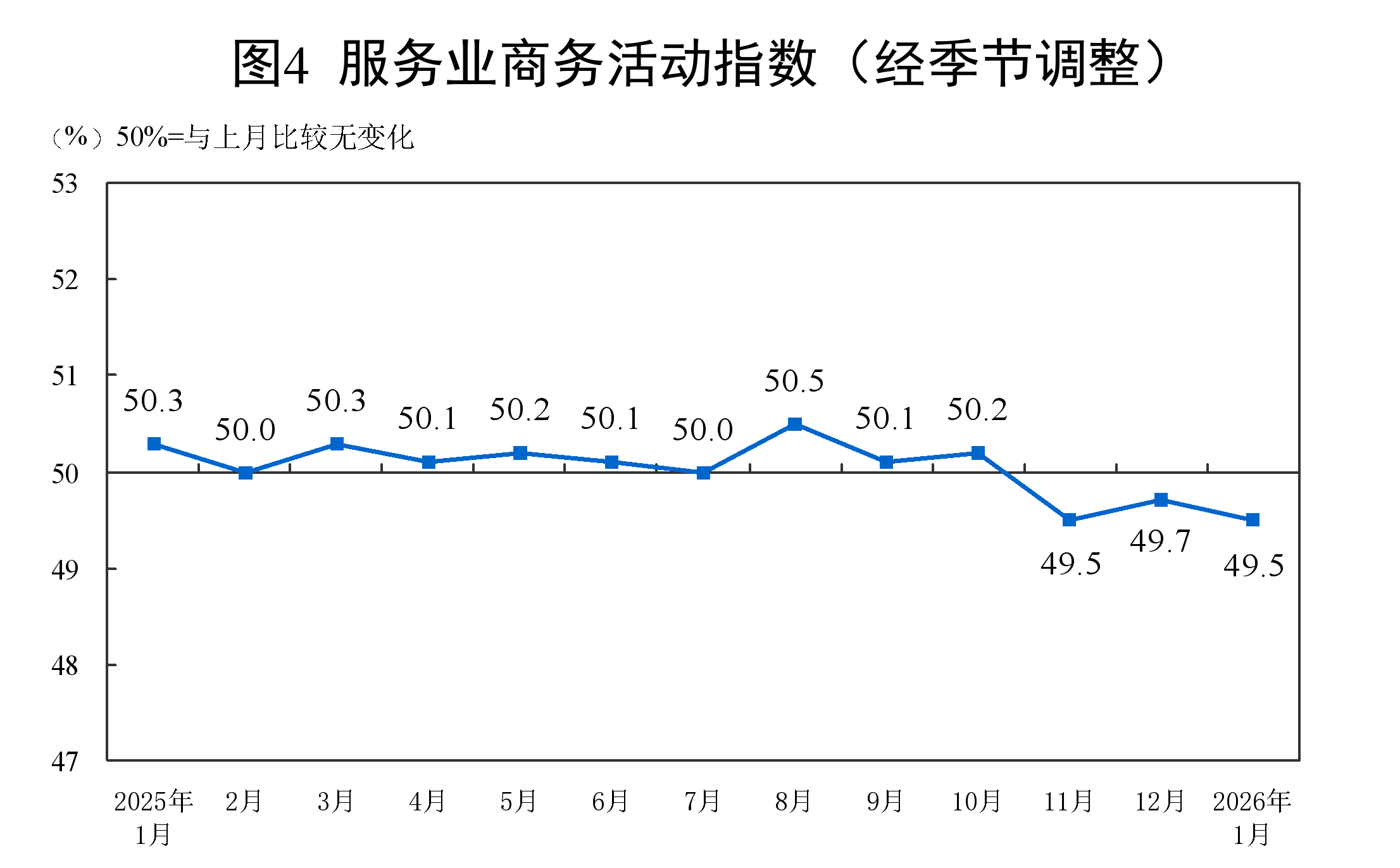

By industry, the construction sector's business activity index was 48.8%, a decrease of 4 percentage points from the previous month; the service sector's business activity index was 49.5%, a decline of 0.2 percentage points from the previous month. Looking at the service sector, the business activity indices for monetary and financial services, capital market services, insurance, and other industries were all above 65.0%; while the business activity indices for wholesale, accommodation, real estate, and other industries were all below the threshold.

The new orders index stood at 46.1%, down 1.2 percentage points MoM, indicating a decline in market demand prosperity in the non-manufacturing sector. By sector, the new orders index for construction was 40.1%, down 7.3 percentage points MoM; the new orders index for services was 47.1%, down 0.2 percentage points MoM.

The input prices index was 50.0%, down 0.2 percentage points MoM, at the threshold, indicating that input prices for non-manufacturing enterprises' operational activities were generally flat compared to the previous month. By sector, the input prices index for construction was 52.0%, up 1.2 percentage points MoM; the input prices index for services was 49.7%, down 0.4 percentage points MoM.

The selling price index was 48.8%, up 0.8 percentage points MoM, indicating that the overall decline in selling prices in the non-manufacturing sector narrowed. By sector, the selling price index for construction was 48.2%, up 0.8 percentage points MoM; the selling price index for services was 48.9%, up 0.8 percentage points MoM.

The employment index was 46.1%, unchanged from the previous month, indicating that the employment prosperity of non-manufacturing enterprises was basically stable. By sector, the employment index for construction was 41.1%, up 0.1 percentage points MoM; the employment index for services was 47.0%, unchanged from the previous month.

The business activity expectations index was 56.0%, down 0.5 percentage points MoM, still remaining in a high prosperity range, indicating that most non-manufacturing enterprises maintain optimistic market expectations. By sector, the business activity expectations index for construction was 49.8%, down 7.6 percentage points MoM; the business activity expectations index for services was 57.1%, up 0.7 percentage points MoM.

III. Operation of China's Composite PMI Output Index

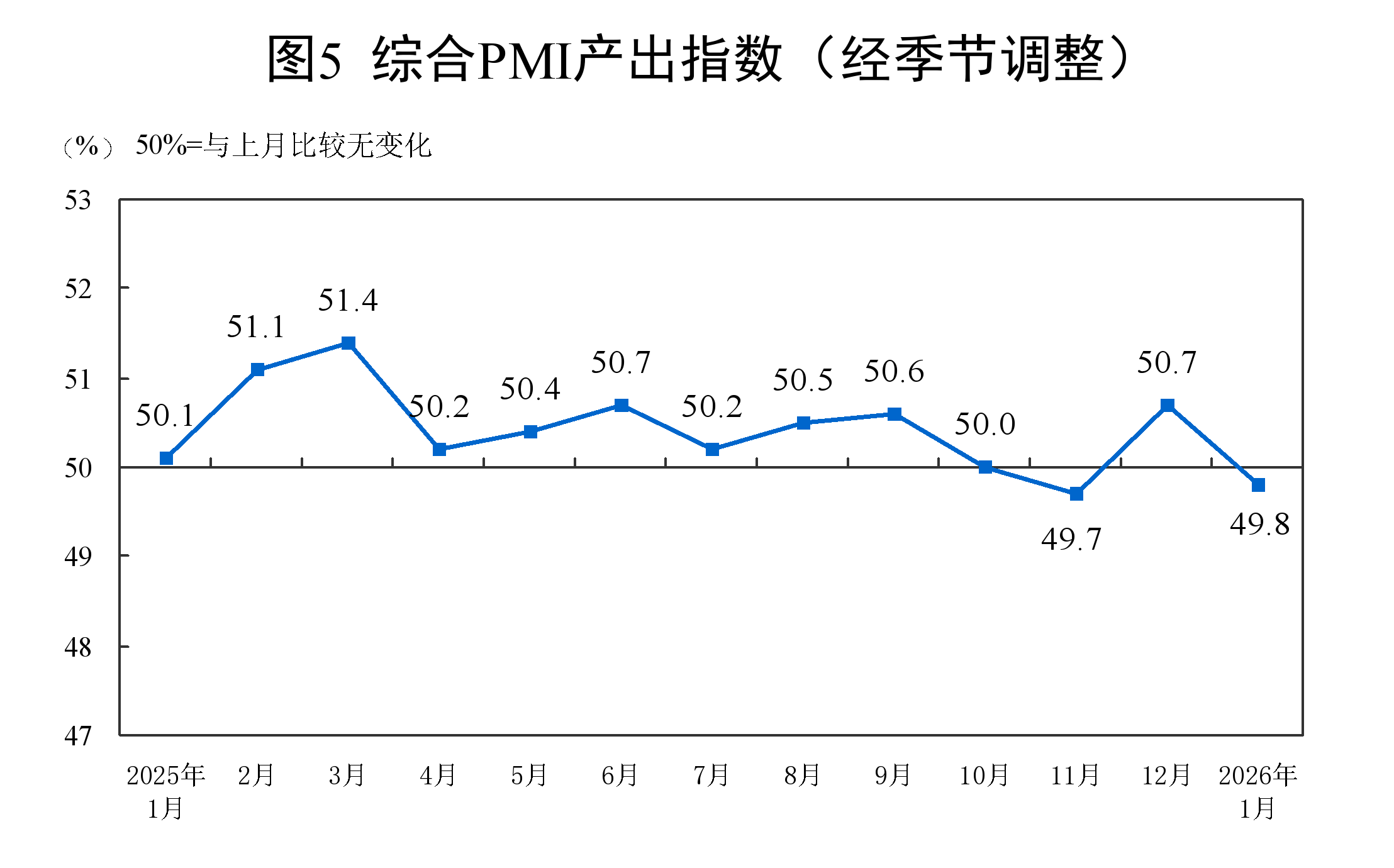

In January, the composite PMI output index was 49.8%, down 0.9 percentage points MoM, indicating that the overall production and operating activities of Chinese enterprises slowed down compared to the previous month.

China's Purchasing Managers' Index Pulled Back in January

—Huoli Hui, Chief Statistician of the NBS Service Industry Survey Center, Interprets China's Purchasing Managers' Index for January 2026

On January 31, 2026, the NBS Service Industry Survey Center and the China Federation of Logistics & Purchasing released China's Purchasing Managers' Index. In this regard, Huo Lihui, Chief Statistician of the Service Industry Survey Center of the National Bureau of Statistics (NBS), provided an interpretation.

In January, the manufacturing PMI, non-manufacturing business activity index, and composite PMI output index registered 49.3%, 49.4%, and 49.8%, respectively, down 0.8, 0.8, and 0.9 percentage points MoM, indicating a pullback in economic prosperity.

I. Manufacturing PMI Declined Slightly, While Production Continued to Expand

In January, as some manufacturing industries entered the traditional off-season and effective market demand remained insufficient, the manufacturing PMI stood at 49.3%, reflecting a decline in prosperity compared to the previous month.

(1) Enterprise production continued to expand. The production index was 50.6%, above the threshold, indicating sustained expansion in manufacturing production; the new orders index was 49.2%, reflecting a pullback in market demand. By sector, the production and new orders indices for agricultural and non-staple food processing, railway, ship, aerospace equipment, and other industries all exceeded 56.0%, indicating rapid release of production and demand; for petroleum, coal, and other fuel processing, automotive, and other industries, both indices were below the threshold, suggesting slowed market demand and a pullback in production in related sectors.

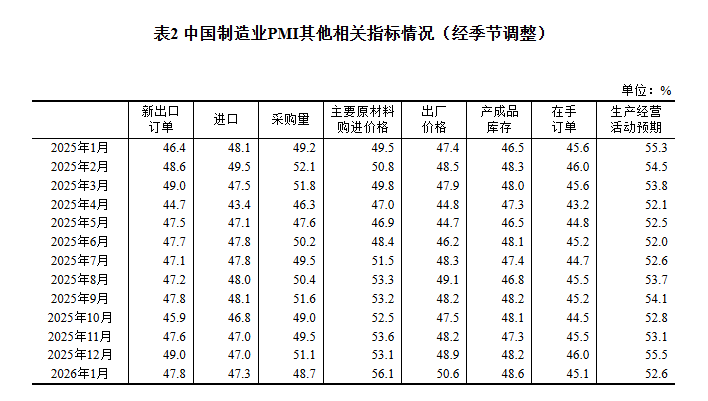

(2) Both price indices rebounded. Influenced by factors such as recent price increases in some bulk commodities, the major raw material purchase price index and ex-factory price index registered 56.1% and 50.6%, respectively, up 3.0 and 1.7 percentage points MoM. Notably, the ex-factory price index rose above the threshold for the first time in nearly 20 months, indicating an overall improvement in the price level of the manufacturing market. By sector, the major raw material purchase price index and ex-factory price index for non-ferrous metal smelting and rolling processing, electrical machinery and equipment, and other industries both rose above 55.0%, reflecting overall price increases for raw material procurement and product sales in related sectors; for timber processing and furniture, petroleum, coal, and other fuel processing, and other industries, both price indices remained below the threshold.

(3) The PMI for large enterprises continued to exceed the threshold. The PMI for large enterprises was 50.3%, remaining in expansion territory, with their supportive role continuing to be evident; the PMI for medium and small enterprises were 48.7% and 47.4%, respectively, down 1.1 and 1.2 percentage points MoM, indicating a pullback in their prosperity levels.

(4) High-tech manufacturing continued to lead. The PMI for high-tech manufacturing was 52.0%, staying at or above the relatively high level of 52.0% for two consecutive months, indicating sustained positive development trends in related industries. The PMI for equipment manufacturing was 50.1%, remaining in expansion territory. The PMI for consumer goods and high-energy-consumption industries were 48.3% and 47.9%, respectively, reflecting a pullback in their prosperity levels.

(V) Enterprise Expectations Remain Optimistic. The business activity expectations index stands at 52.6%, continuing to be above the critical point. By industry, the business activity expectations index for agricultural and sideline food processing, food and beverage refining, and tea industries has remained above 56.0% for two consecutive months, indicating strong confidence among related enterprises in the recent development of their respective industries.

II. Non-Manufacturing Business Activity Index Pulls Back Slightly, Financial Market Activity Remains High

In January, influenced by factors such as a decline in the prosperity of the construction industry, the non-manufacturing business activity index was 49.4%, down 0.8 percentage points from the previous month, indicating a pullback in the overall prosperity level of the non-manufacturing sector.

(I) Service Sector Prosperity Drops Back Slightly. The service sector business activity index was 49.5%, down 0.2 percentage points from the previous month. By industry, the business activity indices for monetary financial services, capital market services, and insurance were all above 65.0%, showing high market activity; the real estate industry's business activity index fell below 40.0%, with a generally weak prosperity level. In terms of market expectations, the service sector business activity expectations index was 57.1%, up 0.7 percentage points from the previous month, indicating that service enterprises' confidence in the near-term market development has strengthened somewhat.

(II) Construction Industry Prosperity Declines. Affected by recent low temperatures and the approaching Chinese New Year holiday, construction production and operations slowed down, with the business activity index at 48.8%, down 4.0 percentage points from the previous month, marking a significant pullback in the construction industry's prosperity level. In terms of market expectations, the construction industry business activity expectations index was 49.8%, dropping below the critical point, suggesting that construction enterprises are cautious about the industry's development prospects.

III. Composite PMI Output Index Slightly Below Critical Point

In January, the composite PMI output index was 49.8%, down 0.9 percentage points from the previous month, indicating that overall enterprise business activities slowed down compared to the previous month. The manufacturing production index and non-manufacturing business activity index, which make up the composite PMI output index, were 50.6% and 49.4%, respectively.