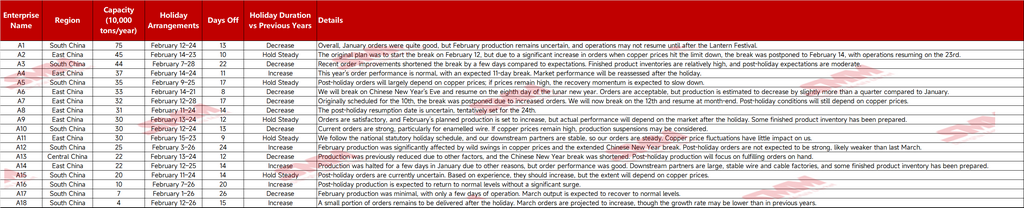

As the Chinese New Year holiday approaches, production and holiday schedules for most copper cathode rod enterprises during the Spring Festival period have been finalized. SMM has conducted detailed analysis through market communication, combined with the year-over-year comparison with 2025, as detailed below:

enterprises shortened their holidays during the 2026 Chinese New Year, but the industry's average holiday duration remained at 15-16 days, basically flat compared to the previous year. The sharp correction in copper prices before the holiday stimulated downstream enterprises to concentrate on buying the dip for procurement.

Downstream enterprises placed concentrated orders on the day of the price limit down, causing daily orders to double and surge significantly. The substantial increase in new orders drove continuous destocking of finished product inventories, prompting enterprises to generally postpone holidays to ensure order delivery. Regional differentiation was significant, with cable and enamelled wire enterprises in South China having longer holidays within their respective segments, which also led to longer holiday durations for upstream copper cathode rod enterprises in the region.

From the stockpiling situation of copper cathode rod enterprises, during the pre-holiday copper price correction, the industry overall maintained a cautious wait-and-see stance. Enterprises generally followed routine production pace to conduct copper cathode procurement, without formulating large-scale raw material stocking plans. The main form of stockpiling focused on reserves of copper rod finished products.

Looking ahead, the industry holds cautious expectations for post-holiday consumption recovery. Enterprises currently prioritize fulfilling orders on hand as the core objective, and future order expectations remain strongly correlated with copper prices.

![As the Chinese New Year approaches, supply reluctance to sell and demand wait-and-see coexist, with both supply and demand weak in the SHFE copper market [SMM Shanghai spot copper]](https://imgqn.smm.cn/usercenter/vdbfy20251217171709.jpg)

![Stockpiling Nears End, Spot Premiums/Discounts Pull Back [SMM North China Spot Copper]](https://imgqn.smm.cn/usercenter/Bwtty20251217171714.jpeg)

![Downstream restocking nears completion as the Chinese New Year approaches, spot trades weaken [SMM South China Spot Copper]](https://imgqn.smm.cn/usercenter/CYktX20251217171711.jpg)