Titanium Concentrate: Market Remained Stable but Weak Pre-Holiday, Prices Await Post-Holiday Demand Guidance

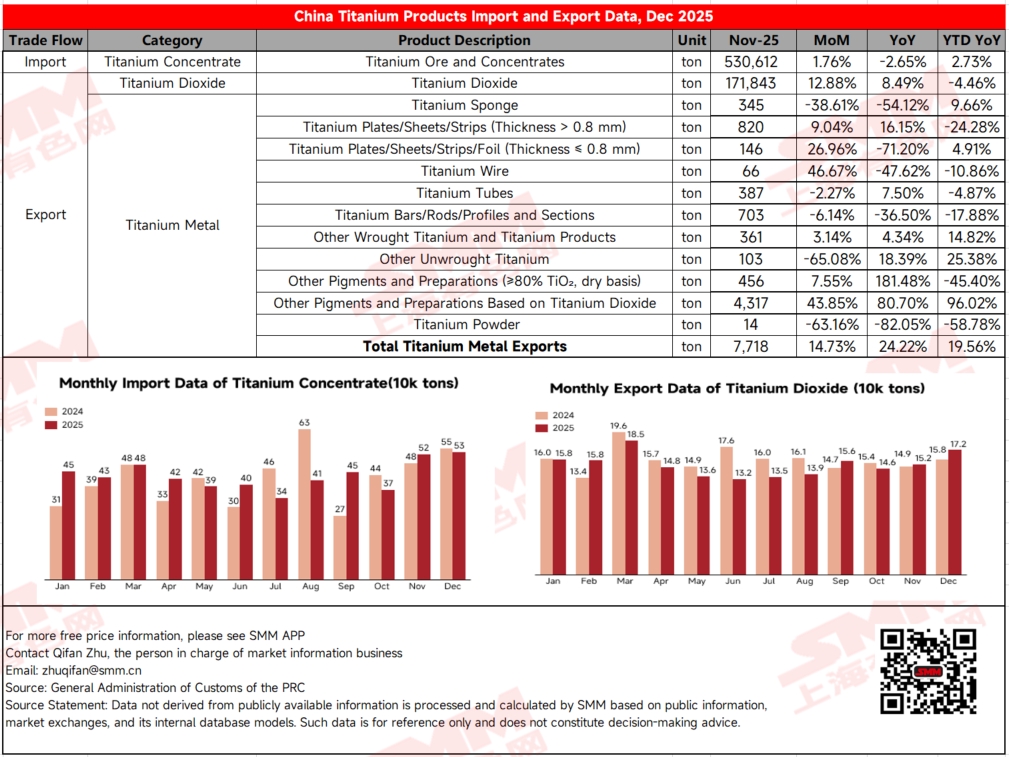

As of February 9, the domestic titanium concentrate market quotations remained generally stable. Among them, TiO₂≥46% grade titanium concentrate was quoted at 1,580-1,630 yuan/mt, with an average price of 1,605 yuan/mt; TiO₂≥47% grade titanium concentrate was quoted at 1,900-1,950 yuan/mt, with an average price of 1,925 yuan/mt. According to customs statistics, China's cumulative titanium concentrate imports for the full year of 2025 reached 5.19 million mt, up 2.73% YoY, indicating the country's continued reliance on imported ore resources.

In January, titanium concentrate prices generally showed a slight pullback, mainly affected by persistently weak downstream demand. Titanium dioxide enterprise production declined in January, and the titanium metal market was also in the doldrums, leading to low overall enthusiasm for raw material procurement and a lack of effective support for titanium ore prices. However, in late January, spot resource supply from some miners became relatively tight, providing some bottom support for local market prices. For imported ore, January quotations also edged down slightly, with the average price for Mozambique-origin TiO₂≥46% titanium concentrate around 1,730 yuan/mt and for Nigeria-origin TiO₂≥50% titanium concentrate around 1,830 yuan/mt, generally adjusting in line with domestic market sentiment.

Overall, the current titanium concentrate market is in a weak supply-demand pattern, with prices lacking clear directional guidance. As the Chinese New Year holiday approaches, market trading tends to be mediocre, and participants are generally focused on the pace of post-holiday downstream work resumption and the strength of demand recovery. The market is expected to gradually stabilize and seek a new equilibrium after the holiday.

Titanium Dioxide: Strong Production and Sales Support Price Increase Willingness; Significant Destocking and Price Recovery in January

As of February 9, anatase titanium dioxide was quoted at 12,000-12,400 yuan/mt, with an average price of 12,200 yuan/mt; rutile titanium dioxide was quoted at 12,800-14,200 yuan/mt, averaging 13,500 yuan/mt, and the FOB average was $1,950/mt; chloride-process titanium dioxide domestic quotes were 13,600-17,000 yuan/mt, averaging 15,300 yuan/mt, with an FOB average of $2,100/mt.

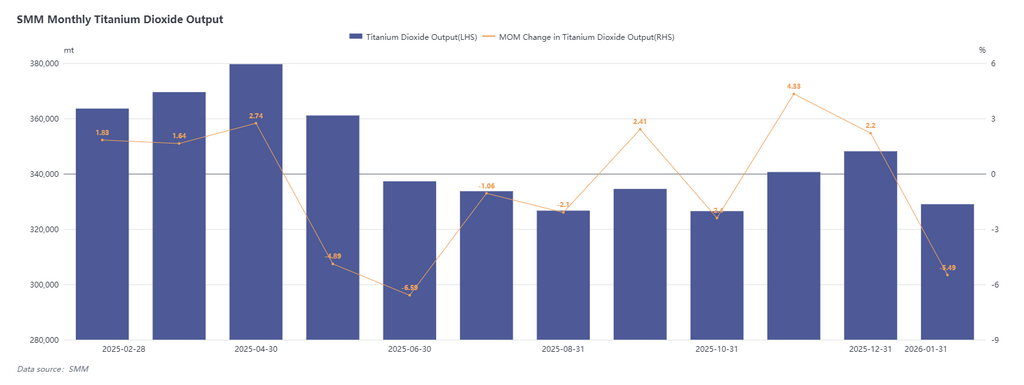

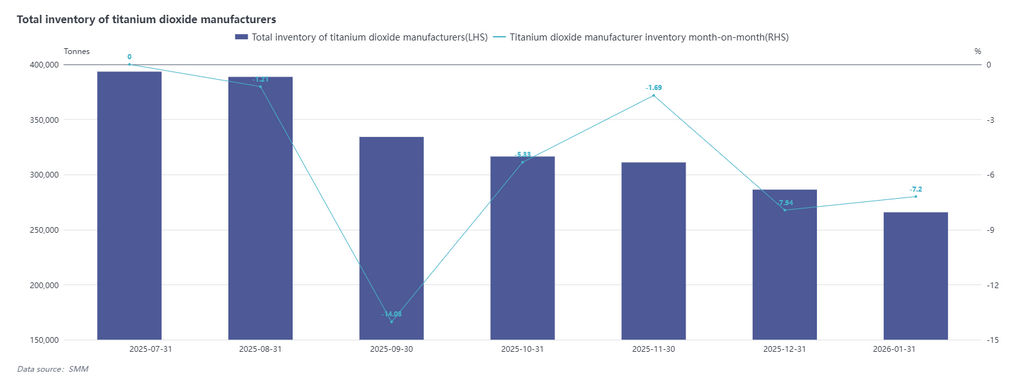

According to SMM data, China titanium dioxide production in January decreased by 5.49% MoM, while producer inventory fell by 7.2% MoM. The production cut was mainly due to phased maintenance shutdowns at titanium dioxide enterprises in January; the sharp inventory decline was attributed to two factors: robust export orders from late November through January, leading to concentrated delivery of export orders by most producers in January, and the release of domestic stockpiling demand ahead of the Chinese New Year, resulting in significant destocking.

In terms of quotes, after titanium dioxide enterprises successively issued price increase letters since late December, the market transaction price for rutile titanium dioxide in January centered around 13,500 yuan/mt, realizing the earlier price hike expectations. Regarding the overall bullish sentiment in January, some enterprises issued another round of price increase letters by month-end, with intentions including: first, due to large order volumes and ample export orders in January, further establishing the upward price trend to reassure downstream clients and validate prior pricing rationality; second, conveying optimism for the 2026 market to boost confidence; third, clarifying current price advantages for clients and agents who stockpiled before the New Year, reinforcing post-holiday bullish expectations. Additionally, top-tier enterprises did not follow up with new price increase letters at month-end, mainly because export order deliveries and domestic stockpiling in January were largely completed, transactions during the February Chinese New Year period were sluggish, and new order follow-up was insufficient, leading most enterprises to wait until after the holiday to assess market sentiment before following up.

Cost side, although sulphuric acid prices remained high, the upward momentum slowed, and by-product ferrous sulphate profitability performed well, keeping titanium dioxide enterprise profits generally positive. In summary, the titanium dioxide market overall showed a bullish pattern in January, with sustained export demand windows supporting stronger market sentiment. However, the domestic market has not seen large-scale concentrated stockpiling, and actual transactions remain dominated by just-in-time procurement. Subsequent price trends will mainly depend on the actual delivery of post-holiday orders and the scale of newly signed orders. The period from February to March is expected to be a critical phase for titanium dioxide prices to achieve recovery.

Titanium Metal: Supply-Demand Balance Supports Price Stabilization, Overseas Demand Emerges as Core Growth Driver in 2026

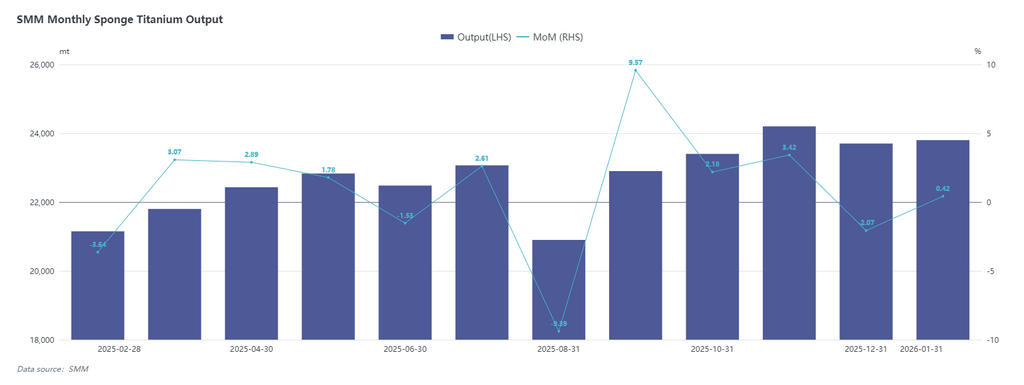

As of February 9, the price of grade 0 sponge titanium was quoted at 46,000–47,000 yuan/mt, with the FOB price quoted at $6,800–7,100/mt. According to the SMM survey, sponge titanium production in January reached 23,800 mt, up 0.42% MoM. Cumulative sponge titanium exports in 2025 totaled 6,574 mt, up 9.66% YoY. In addition, total titanium metal exports in 2025 increased by 19.56% compared to the same period last year.

Price side, sponge titanium prices continued their previous downward trend in 2026, showing a slight decline. However, after some enterprises successively issued price adjustment notices in mid-January, market prices stopped falling and stabilized. Currently, the overall supply-demand fundamentals of the industry have not shown significant fluctuations. Given the absence of clear growth drivers in the domestic titanium market this year, the titanium metal market is expected to maintain a stable operating trend. Considering that the export market already showed signs of recovery in 2025, demand growth in 2026 is still expected to rely mainly on expansion in overseas markets.

![Tungsten Market Rises with Long-Term Contract Price Increases, Pre-Holiday Market Sees Shrinking Volume and Rising Prices [SMM Tungsten Daily Review]](https://imgqn.smm.cn/usercenter/qjvqf20251217171725.jpg)

![The magnesium market remained stable before the holiday, with a growing wait-and-see sentiment prevailing [SMM Magnesium Morning Meeting Minutes]](https://imgqn.smm.cn/usercenter/QmrGh20251217171725.jpg)