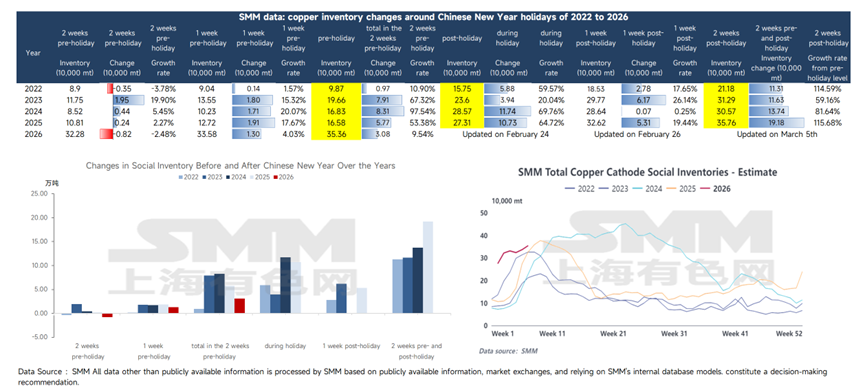

In the two weeks before the Chinese New Year, SMM social inventory of copper cathode only saw an inventory buildup of 30,800 mt, marking the lowest level for the same period in the past four years and falling significantly below previous market expectations.

In the days leading up to this year's Chinese New Year, the inventory buildup process for copper cathode significantly slowed down. Even during the traditional pre-holiday inventory accumulation window, the growth in inventories noticeably narrowed. Particularly during the week when copper prices hit limit down, domestic copper cathode inventories even saw some destocking, breaking the conventional pattern of pre-holiday inventory accumulation.

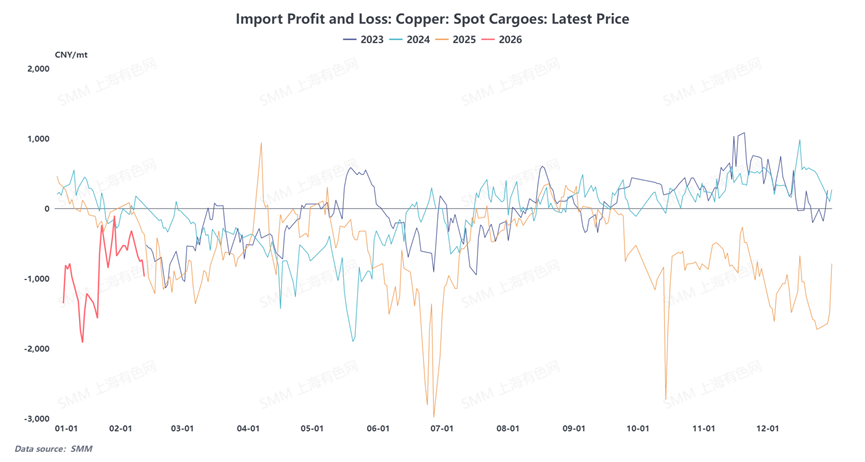

Structural tightening on the supply side was the core driver behind the slowdown in inventory buildup. On the import side, the export window remained closed for an extended period, leading to a significant YoY decline in arrivals of imported copper, with overall supply of imported material remaining tight. Domestic supply also contracted, with China's copper cathode production in February estimated at 1.1435 million mt, down 35,800 mt (a 3.04% decrease) MoM. Coupled with the opening of the export window, increased exports of copper cathode further diverted market-available supply from the domestic market.

On the demand side, persistently high copper prices continued to suppress downstream consumption, resulting in a high base for social inventory. Subsequently, a phased decline in copper prices triggered concentrated restocking demand from downstream buyers, with rigid demand effectively offsetting the pre-holiday consumption weakness. This also became a key factor contributing to the slowdown in inventory accumulation.

Overall, insufficient import arrivals, contraction in domestic supply, coupled with relatively strong downstream consumption, collectively resulted in a pre-holiday copper cathode inventory buildup significantly lower than the same period in previous years. During the 2026 Chinese New Year, various copper semis categories averaged 13-14 days of holiday shutdowns, with the overall duration basically flat compared to 2025. During and after the Chinese New Year, domestic copper cathode supply is expected to decline YoY, combined with smelters increasing exports during the holiday period, further tightening domestic supply. Demand side, according to SMM, the operating rate of copper cathode rod enterprises this week was 56.64%, down 12.43 percentage points WoW, but up 1.47 percentage points YoY compared to the week before the Chinese New Year last year. The operating rate for February 13-19 was 13.08%. Currently, some downstream enterprises have not conducted large-scale raw material stockpiling, leaving some room for restocking. The post-holiday inventory trend will largely depend on the pace of downstream consumption recovery. If copper prices remain stable after the holiday, downstream orders gradually recover, and operating rates steadily rebound, it is expected to lead to a limited buildup in social inventory post-holiday, maintaining overall low levels compared to recent years.

![The most-traded BC copper contract closed up 0.43%, with trading activity sluggish as the Chinese New Year holiday approaches. [SMM BC Copper Review]](https://imgqn.smm.cn/usercenter/mPNrH20251217171709.jpg)

![Concentrated Holidays Ahead of Chinese New Year, Brass Billet Operating Rate Pulls Back MoM [SMM Brass Billet Market Weekly Review]](https://imgqn.smm.cn/usercenter/ieria20251217171709.jpg)