Published: 08 Feb 2026, 16:02 PM

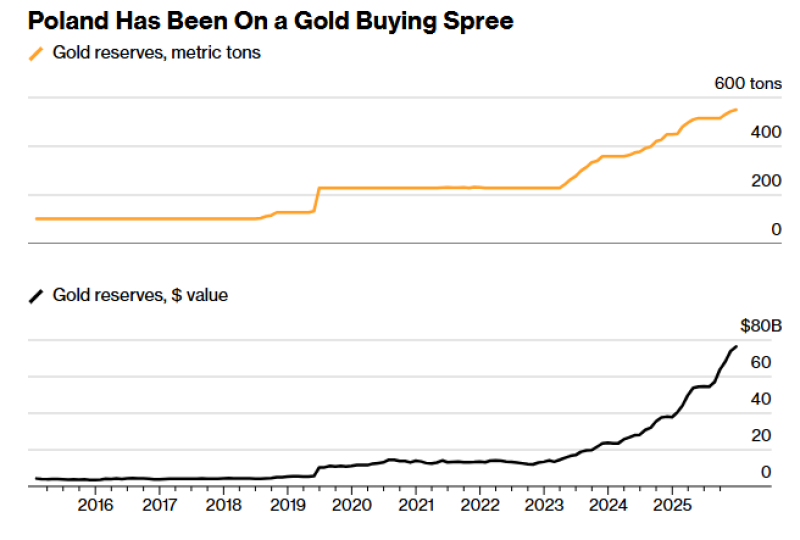

⬤ Poland is making a bold bet on gold. The National Bank of Poland is planning to buy up to 150 tons of the precious metal, according to Bloomberg - a purchase that would catapult the country into the top ten gold holders worldwide.

⬤ If the plan goes through, gold could make up roughly 30% of Poland's total reserves. That's a massive shift in how the country thinks about storing wealth. What makes this even more striking is the timing: gold prices are hovering near all-time highs, yet Poland's central bank is charging ahead anyway. This isn't about catching a dip—it's about long-term strategy. Similar trends are playing out globally, as seen in central bank gold accumulation trend.

⬤ Poland's move signals something bigger than just one country's reserve policy. Central banks worldwide are clearly rethinking what belongs on their balance sheets, and gold is increasingly winning that debate. As one analyst noted, "Increasing allocation to physical reserves indicates a structural preference for tangible reserve assets." It's not about short-term price swings anymore—it's about building a foundation that can weather uncertainty.

⬤ This shift echoes broader patterns in how nations are managing their wealth. More countries are diversifying away from traditional reserve assets and turning to gold as a core holding. The trend appears in global reserve diversification into gold and the ongoing monetary reserve asset transition.

⬤ Poland's planned purchase underscores gold's evolving status in modern finance. What was once seen as a relic is now being treated as a must-have component of sovereign portfolios. As central banks continue piling into bullion, it's becoming clear: gold isn't just a safe haven—it's becoming essential infrastructure for national reserves in an unpredictable world.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)