Nickel Ore

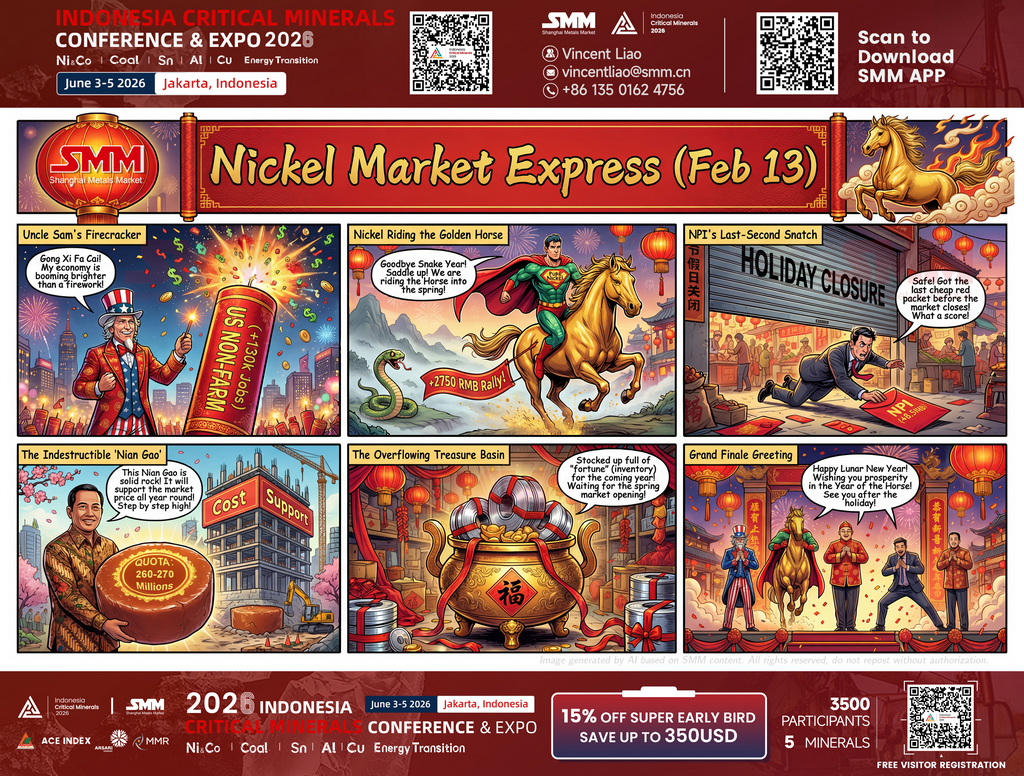

Indonesian domestic nickel ore prices saw a significant increase this week. For the first half of February, the Indonesian Nickel Ore Benchmark Price (HPM) was set at $17.774 per dry metric tonne (wmt), marking an 8.2% increase month-on-month. According to SMM data on Indonesian nickel ore premiums, the average premiums for 1.4%, 1.5%, and 1.6% grade laterite nickel ore were reported at $25, $29, and $29.5 per wmt, respectively, remaining flat compared to the previous week. Notably, the delivered price (CIF) for 1.6% grade ore reached $59.4–$62.4 per wet metric tonne. This dual strengthening of both the benchmark price and premiums reflects a release of restocking demand from smelters and pessimistic expectations regarding RKAB quota reductions; meanwhile, the delivery price for 1.3% grade hydrometallurgical ore also edged up to $23–$25 per wmt.

- Pyrometallurgical Ore:

From a supply-demand fundamental perspective, although rainfall has eased and ore moisture content has decreased for pyrometallurgical ore, supply growth remains limited due to ongoing inspections by forestry task force. In addition, the MOMS verification for several miners are still locked, which lets the miners unable to conduct further sales. This has led some NPI smelters to ramp up procurement this month to hedge against quota uncertainties.

- Hydrometallurgical Ore

The supply in the market is relatively ample, the commissioning of new MHP capacity combined with growing demand from outer islands has led to a significant recovery in overall demand.

Regarding the price outlook, the slight fluctuations in the Indonesian benchmark price are expected to have a minimal impact. In the short term, influenced by expectations of RKAB reductions from several leading mines, smelters are anticipated to raise nickel ore premiums further to secure feedstock and seize market supply. On the policy front, the market is closely monitoring the 2026 nickel ore RKAB quotas released by the Indonesian Ministry of Energy and Mineral Resources (ESDM) on February 10. Director General Tri Winarno confirmed that the approved production for this year is limited to only 260 million to 270 million tonnes. This tightening trend is particularly evident in key projects; according to official news from Eramet, Weda Bay Nickel (WBN) received an initial quota of only 12 million wmt, a drastic reduction from last year’s 42 million wmt.

Nickel Pig Iron

"Cost support combined with bullish expectations leads to a warming of pre-holiday trading in high-nickel pig iron"

The average price of SMM 10-12% NPI average price rose by RMB 9.6 per nickel unit week-on-week to RMB 1045.4 per nickel unit (ex-works, tax included), while the Indonesia NPI FOB index increased by USD 1.81 per nickel unit to USD 133.01 per nickel unit. This week, the high-nickel pig iron market showed a trend of stable operation at the beginning of the week and was supported by macro sentiment at the end of the week. Market activity picked up again in the last few trading days before the Spring Festival.

From the supply side, although the nickel price fluctuations this week did not exceed the previous high, under the influence of the implementation of the Indonesian RKAB quota news, the expected tight supply drove up the ore price significantly, and with cost support, smelters continued to hold bullish views and their quotes remained firm. From the demand side, as the Spring Festival holiday approaches, downstream steel mills have completed their stockpiling, making it difficult for actual demand to be released. However, due to the quota news triggering bullish expectations after the holiday, the stockpiling demand of some downstream enterprises and traders was released. In the last few trading days before the holiday, trading in the high-nickel pig iron market became active again, driving the price to rise again. Overall, as the Spring Festival holiday approaches, although the Spot Market is relatively quiet, cost support and the bullish logic after the holiday remain unchanged. Looking ahead to the after-market, based on the current ore price, the production cost of high-nickel pig iron has risen significantly, and cost support and the short-term expectation of tight supply at the ore end are expected to drive the price of high-nickel pig iron to maintain an upward trend after the holiday.

![[SMM Analysis] Nickel Prices Swing as Indonesian Targets and Market Sentiment Drive Volatility](https://imgqn.smm.cn/usercenter/fzwTi20251217171733.jpg)

![[SMM Analysis] Nickel Intermediate Product Market Experiences Holiday Stagnation, Trading Sluggish](https://imgqn.smm.cn/usercenter/GmHLU20251217171733.jpg)