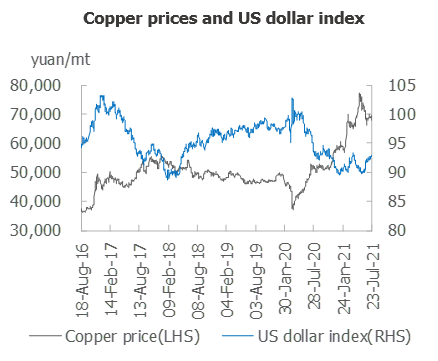

SHFE copper prices rallied from lows last week. Prices edged up from 67,500 yuan/mt and tested the 70,000 yuan/mt mark on Friday. European and US stock markets plunged sharply on Tuesday evening amid market concerns over the Delta strain, while SHFE copper prices opened lower. But the US retail data recovery in June exceeded expectations, and consumption improved in the services industry, bolstering the dollar.

The US will maintain dovish stance before significant improvement in employment data. The European Central Bank left benchmark interest rate and the scale of asset purchases unchanged, but revised the forward-looking guidelines, closely linking policy adjustments to the achievement of the new 2% inflation target. President Lagarde said that the bank would not tighten monetary policy prematurely.

PMI and CPI data from Europe and the US as well as Powell’s address at the Fed's meeting on interest rates will be the market focus this week.

On fundamentals, the second round of copper reserves by the State Reserve Bureau stood at 30,000 mt, and this will have a limited impact on the supply and demand balance in H2. Some areas of Henan underwent severe floods last week. In some areas of Guangdong, power restriction pressure eased as the temperature has dropped recently. The impact of power curtailment or flooding on copper supply and demand is relatively limited. Domestic copper consumption remains strong in the off-season from July to August as the price declines have incentivised dip purchasing. Copper cathode consumption exceeded expectations amid tight copper scrap supply and a narrower price spread between copper cathode and copper scrap. Continuous declines in domestic social inventories have underpinned copper prices. However, the opening of the import window resulted in an influx of imported copper. This, combined with the completion of maintenance at smelters is likely to accumulate domestic inventories in early August, weighing on copper prices.

SHFE copper prices have strong support around 67,000 yuan/mt, but will meet resistance from 70,000 yuan/mt mark.

SHFE copper prices are expected to move between 67,500-70,000/mt this week, and LME copper will trade between $9,200-9,550/mt.

The execution of long-term contracts is coming to an end. Most of the trades will be cargoes with next-month invoices. Spot premiums are likely to fall slightly even with the destocking of imported copper. However, continued declines in domestic social inventories will limit the downward room. Spot premiums are expected to move between 280-380 yuan/mt this week.