Oil is one of those commodities where the price is published continuously. Crude oil is the most traded commodity in the world (followed by coffee). The question is how does knowing the oil price help in assessing and managing your investments?

Oil is crucial to our modern economy. And while we may feel that the world is going greener and petroleum-run vehicles are becoming old school, virtually everything that we use on a daily basis, whether it’s one’s car, air travel, plastics, every-day consumer products, the vast majority of these are derived from oil and depend heavily on the global oil supply chain.

Oil – the Dutch disease

The resource curse, or Dutch disease are often used synonymously when considering oil producers. The term came into being in 1977 when gas was discovered in Holland and subsequently resulted in various economic problems for the country.

A Dutch disease refers to an economic phenomenon where the development of one sector of an economy, particularly in the case of natural resources, starts a decline in other sectors or crowds out investment in other areas of the economy.

If one considers the oil-rich countries in Africa, particularly in Nigeria, Angola, and Libya, weak political and financial institutions meant that they could not efficiently manage their vast oil reserves. Therefore instead of having a positive impact on these economies, their oil endowments led to corruption, rent-seeking by politicians and a political system of patronage.

Some countries benefited immensely from their oil and gas endowment

One country that did benefit from their oil wealth was the United States, which at the beginning of the 20th century was the biggest producer of oil in the world. This facilitated the development of the automobiles, their refinery industry and plastics infrastructure that allowed for the US to grow to the dominant position that it holds today.

More recently, countries like Norway took the view that the discovery of oil for their country is something that should not only belong to the current generation, but should rather be kept for future generations as well. Norway therefore developed a sovereign wealth fund where they started with some money that could be fed to the economy during down cycles. Similar examples where this was done include the UAE, which works slightly differently to Norway, but they use oil as a basis for sustained development. Yet countries such as Dubai have made a concerted effort to diversify their economy from oil dependency. These are examples of countries where oil has been a benefit, but Africa and South America are littered with examples where this has not been positive for the country.

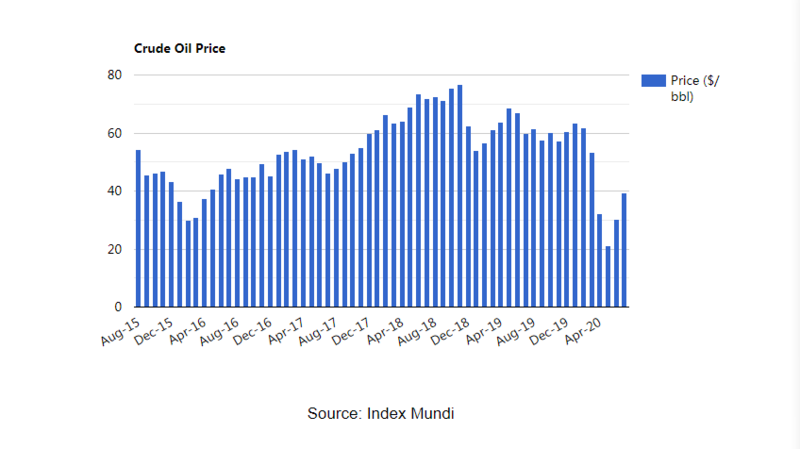

Oil has gyrated wildly in 2020

2020 has been a remarkable year for oil characterized by extremely volatile prices. At the beginning of the year, oil was trading at around $60/bbl and that plunged to forty dollars. Then in March/April as COVID19 took its grip across the globe, oil prices actually went negative intraday in the US. Since then it’s bounced back to current levels of just over 40 dollars a barrel and it’s going to be very interesting to see how this plays out.

Right now, OPEC’s goal is to stabilize the oil price for the benefit of members that have experienced the COVID impact shock which led to a dramatic drop in demand. At the same time, there’s been rapidly rising oil and gas supply over the last few years, particularly from the US. As commodity prices are generally driven by the relative supply and demand balance, this year there’s been a couple of unexpected events that have really led to a period of immense volatility.

With share prices having plunged, many companies could possibly be forced into a rights issue and more than a few are expected to have to start selling assets.

How does oil impact investors?

What does this mean for investors? What role does oil and gas play?

When considering one’s investment portfolio, it is important to first understand some of the behavioural changes that might be happening now as a result of the pandemic and the lockdown that most of us are experiencing. The first one is obviously how quickly the global economy might rebound from this. Then you have the WFH (Work from home) trend- is this something that will permanently impact the work environment or is this a unique and isolated situation?

Are all office workers going to avoid taking public transport and instead drive themselves to work thereby using more oil? Will this increase in demand be counterbalanced by more people locking onto the WFH movement?

The UK’s NHS has just announced a subsidy for people to either repair their bicycles or purchase a bicycle or e-bike to ride to work. Will this spark an increased use of cycling, and more environmentally friendly modes of transport?

Furthermore, there has been a massive impact on global travel and tourism. So, if we consider countries that are highly dependent on global tourism, Chinese tourists being the fastest growth market for most of the globe’s tourism industry. This trend of people having to postpone holidays indefinitely has also affected oil prices. Ordinarily when oil prices decline, air travel would be cheaper and that would theoretically spark more people to travel, but that is not going to happen right now.

Another strong trend is a trend towards electric vehicles and a move towards a greener economy that is driving the adoption of electric vehicles. What impact will this have on internal combustion engine cars? And all this without even going into the trade war between China and the US and how this might affect globalization in terms of restoring or bringing back domestic supply lines. We are in a period of lots of uncertainty and many trends that could make short- and long-term impacts on oil. These are the questions one needs to grapple with when considering an oil investment and there are many aspects for investors to keep in mind and many different angles from which to consider the oil market.